#Spinning

Oerlikon announces robust first-quarter performance - INglass acquisition positions Polymer Processing Solutions for growth

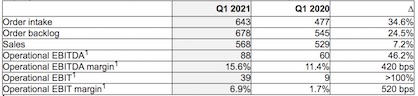

- Group Q1 order intake +34.6%, sales +7.2% and operational EBITDA +46% year-over-year.

- Surface Solutions operational EBITDA margin improved to 17.7%, driven by structural cost-out actions and a better business mix. Sales recovery in automotive, tooling and general industries continues, while aerospace remains slow.

- Polymer Processing Solutions first-quarter results are on track with full-year guidance. Recently announced acquisition of INglass is expected to be immediately margin and cash accretive on completion and positions the Division for growth.

- 2021 guidance confirmed.

Key Figures of the Oerlikon Group as of March 31, 2021 (in CHF million)

“Our strategic move in Polymer Processing Solutions with the recently signed agreement to acquire INglass positions the Division to diversify beyond filaments into the larger and more profitable polymer market. We expect the Division to be an important growth driver for the Group,” added Dr. Fischer.

Robust First-Quarter Performance

Group orders increased globally by 34.6% to CHF 643 million. Group sales improved by 7.2% to CHF 568 million, which is attributed to an increase in demand in the filament equipment, automotive and tooling industries in China and India. At constant exchange rates, Group sales increased year-over-year by 7.5% to CHF 569 million.

Operational first-quarter EBITDA was CHF 88 million, or 15.6% of sales, representing a year-over-year improvement of 420 basis points (bps). First-quarter operational EBIT was CHF 39 million, or 6.9% of sales (Q1 2020: CHF 9 million; 1.7%). The margin improvements were driven by benefits from structural cost actions, positive operating leverage and a better business mix in Surface Solutions.

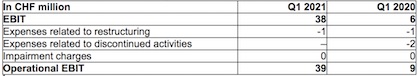

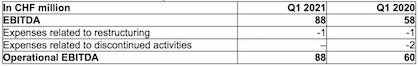

Group first-quarter EBITDA was CHF 88 million, or 15.4% of sales (Q1 2020: CHF 58 million, 11.0%), and EBIT was CHF 38 million, or 6.7% of sales (Q1 2020: CHF 6 million, 1.1%). The reconciliation of the operational and unadjusted figures can be seen in the tables below.

Table I: Reconciliation of Q1 2021 Operational EBITDA and EBITDA1

Table II: Reconciliation of Q1 2021 Operational EBIT and EBIT1

New Growth Pillar for Polymer Processing Solutions Division

The agreement to acquire INglass, as announced on April 23, 2021, marks a strategic step for Polymer Processing Solutions, which was previously named Manmade Fibers. This move is in line with the Division’s growth strategy to reposition itself and gain a strong foothold in the polymer processing market.

The increasing demand for sustainable, lightweight and durable solutions is driving the usage of polymers across industries such as automotive, construction and packaging. For example, in new vehicles, including electric and hybrid vehicles, weight reduction is very important to reduce energy consumption. This strategic acquisition will accelerate and enhance the Division’s organic initiatives to grow its polymer processing capabilities and products, as it further diversifies into new growth areas.

INglass is a market leader in providing hot runner systems under the brand HRSflow. These systems are used to enable effective and energy-saving plastic injection molding. In 2020, INglass had sales of approximately CHF 135 million and a global workforce of around 1 000 employees. Pending the customary merger control approvals, the acquisition is expected to be completed in the second quarter of 2021. Once completed, INglass will be integrated with the existing polymer flow control business into the new Business Unit Flow Control Solutions, which will become a pillar of growth for the Division.

Oerlikon Confirms 2021 Guidance

As vaccinations progress globally, it is expected that pent up demand will drive an increase in consumptions and consequently boost business. Assuming that the COVID-19 pandemic does not cause further major disruptions and markets continue to improve, Oerlikon expects sales of CHF 2.35 billion to CHF 2.45 billion and an operational EBITDA margin of 15.5% to 16.0% in 2021.

Division Overview

Polymer Processing Solutions Division

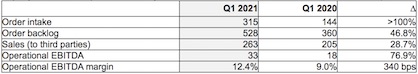

Key Figures of the Polymer Processing Solutions Division as of March 31, 2021 (in CHF million)

The Division delivered a very strong year-over-year increase due to a robust first-quarter performance and the comparison with a pandemic-impacted Q1 2020. Order intake increased significantly by 119.0% to CHF 315 million, compared to CHF 144 million in 2020. Sales increased by 28.7% to CHF 263 million year-over-year, driven mainly by India and China. At constant exchange rates, sales increased by 27.0% to CHF 260 million.

Operational EBITDA improved year-over-year to CHF 33 million, or 12.4% of sales, compared to CHF 18 million, or 9.0% of sales, in Q1 2020, due to improved operating leverage. Unadjusted EBITDA was CHF 33 million, or 12.4% of sales (Q1 2020: CHF 18 million, 8.9%). Operational EBIT was CHF 24 million, or 9.3% of sales (Q1 2020: CHF 11 million, or 5.6% of sales). Unadjusted EBIT was CHF 24 million, or 9.3% of sales (Q1 2020: CHF 11 million, or 5.5% of sales).