#Spinning

Oerlikon with strong third-quarter results

- Group sales increased by 7% year-over-year, 12.5% FX adjusted, and operational EBITDA grew by 8% in Q3.

- Polymer Processing Solutions achieved 6% sales growth, 12.3% FX adjusted, and 17% operational EBITDA growth in the third quarter. Q3 orders -16.8%, -12.8% FX adjusted. Year-to-date orders +12% and sales +21%.

- Surface Solutions increased sales by 7%, 12.6% FX adjusted in Q3. Operational EBITDA margin transitorily impacted by product mix and higher energy costs.

- 2022 Group Guidance updated: Oerlikon expects sales >CHF 2.9 billion and operational EBITDA margin of 17.0–17.5%.

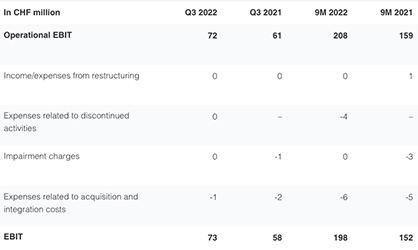

Q3 operational EBIT was CHF 72 million, or 9.8% of sales (Q3 2021: CHF 61 million; 8.7%). The margin improvements are attributed to higher sales and the benefits of cost actions executed by the Group.

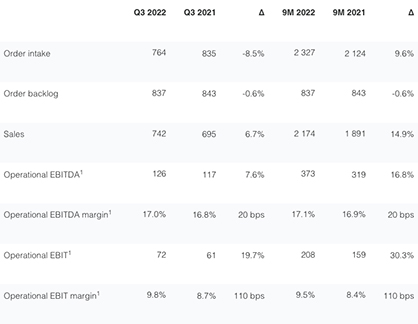

Key figures for the Oerlikon Group as of September 30, 2022 (in CHF million)

1) For the reconciliation of operational and unadjusted figures, please see table I and II of this media release.

“Our teams have executed extremely well in the first nine months of the year against a clearly more difficult macroeconomic environment. Leading indicators signal an upcoming downturn, however, the timing and scope are difficult to predict. We are already implementing measures to mitigate potential impacts, and remain confident in our mid-term strategy,” said Michael Suess, Executive Chairman, Oerlikon Group.

“Based on our year-to-date performance, we are now expecting Group sales to exceed CHF 2.9 billion and the operational EBITDA margin to be between 17.0% and 17.5% for the full year,” added Suess.

Robust Q3 2022 Performance

Group order intake decreased by 8.5% to CHF 764 million, attributed to Polymer Processing Solutions’ record order intake in Q3 2021. Sales increased by 6.7% to CHF 742 million. At constant exchange rates, Group sales increased by 12.5%.

Operational EBITDA for the third quarter improved by 7.6% to CHF 126 million, and the operational EBITDA margin improved by 20 basis points to 17.0%. Q3 operational EBIT was CHF 72 million, or 9.8% of sales (Q3 2021: CHF 61 million; 8.7%). The margin improvements are attributed to higher sales and the benefits of cost actions executed by the Group.

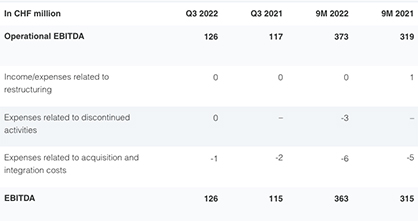

Group Q3 unadjusted EBITDA was CHF 126 million, or 16.9% of sales (Q3 2021: CHF 115 million, 16.6%), and EBIT was CHF 73 million, or 9.8% (Q3 2021: CHF 58 million, 8.3%). The reconciliation of the operational and unadjusted figures can be seen in the tables below.

Table I: Reconciliation of Q3 2022 and 9M 2022 operational EBITDA and EBITDA1

Table II: Reconciliation of Q3 2022 and 9M 2022 operational EBIT and EBIT1

1) All amounts (including totals and subtotals) have been rounded according to normal commercial practice. Thus, an addition of the figures presented can result in rounding differences.

2022 Group Guidance updated

For the full year, Oerlikon expects sales to exceed CHF 2.9 billion (previously around CHF 2.9 billion) and the operational EBITDA margin to be between 17.0 and 17.5% (previously around 17.5%).

Division Overview

Surface Solutions division

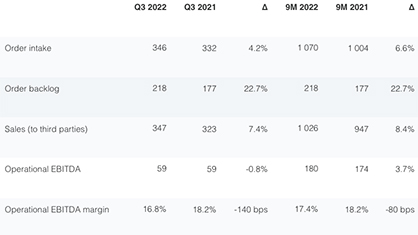

Key figures for the Surface Solutions division as of September 30, 2022 (in CHF million)

Despite softening industrial activity, Surface Solutions increased order intake by 4.2% to CHF 346 million and sales by 7.4% to CHF 347 million. The higher sales were attributed to recovery in aerospace and in automotive, the latter driven by gradually easing of the supply-chain shortages.

The Q3 operational EBITDA margin decreased by 140 basis points to 16.8%, reflecting product mix effects and higher energy costs. Operational EBIT was CHF 22 million, or 6.4% of sales (Q3 2021: CHF 19 million, 6.0%). The division’s unadjusted Q3 EBITDA was CHF 59 million or 16.9% of sales (Q3 2021: CHF 58 million, 18.0%). EBIT was CHF 23 million, or 6.5% of sales (Q3 2021: CHF 18 million, or 5.5%).

Polymer Processing Solutions division

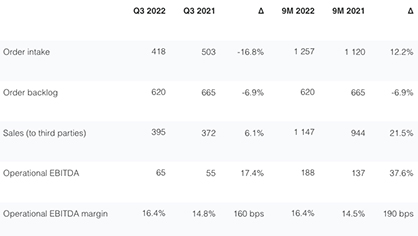

Key figures for the Polymer Processing Solutions division as of September 30, 2022 (in CHF million)

Polymer Processing Solutions delivered another quarter of robust results. Sales increased by 6.1% to CHF 395 million. Order intake was sustained at a high level at CHF 418 million. Compared to the prior year, order intake was lower due to the record level of order intake in Q3 2021.

Q3 operational EBITDA improved by 17.4% to CHF 65 million. The operational EBITDA margin of 16.4% was 160 basis points higher year-over-year, due to improved operating leverage and cost control. Operational EBIT was CHF 51 million or 12.9% of sales (Q3 2021: CHF 40 million, 10.9%). The division’s unadjusted Q3 EBITDA was CHF 65 million, or 16.4% of sales (Q3 2021: CHF 52 million, 13.9%), and EBIT was CHF 51 million or 12.8% of sales (Q3 2021: CHF 37 million, 9.9%).