#Spinning

Strong quarter of sales growth and margin improvement at Oerlikon Polymer Processing Solutions

Strong Q2 Performance Confirming Growth Strategy

- Group orders +19%, sales +17%, operational EBITDA +15% vs. prior year.

- Polymer Processing Solutions orders significantly increased by 40%, sales by 24% and operational EBITDA by 33% year-over-year, driven by strong execution.

- Surface Solutions sales increased by 10% vs. prior year. Operational EBITDA improved by 4%.

- 2022 Group guidance confirmed.

Key figures for the Oerlikon Group as of June 30, 2022 (in CHF million)

1) For the reconciliation of operational and unadjusted figures, please see table I and II on page 2 of this release.

“In Surface Solutions, we experienced improved demand, even as many of our end markets still face supply chain challenges. While macroeconomic uncertainties increase, we have not seen any unanticipated impacts to date. We are closely monitoring the situation and focusing on further improving our cost competitiveness,” added Süss. “Polymer Processing Solutions continued to execute and delivered another strong quarter of sales growth and margin improvement, driven by filament and non-filament.”

Strong Second Quarter

Group orders increased by 19.5% to CHF 773 million, driven by strong demand in both the filament and non-filament business in Polymer Processing Solutions. Group sales increased globally by 16.9% to CHF 734 million, attributed to growth in both Surface Solutions and Polymer Processing Solutions. At constant exchange rates, Group sales increased by 19.7%.

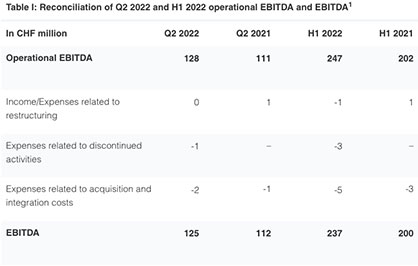

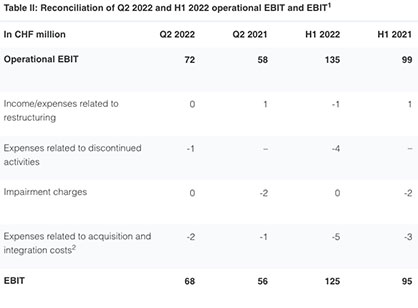

The operational EBITDA for the second quarter improved by 15% year-over-year to CHF 128 million, corresponding to a margin of 17.4%. Operational EBIT for Q2 2022 was CHF 72 million, or 9.8% of sales (Q2 2021: CHF 58 million, 9.2%). Q2 2022 EBITDA was CHF 125 million or 17.0% of sales (Q2 2021: CHF 112 million, 17.8%), and EBIT was CHF 68 million, or 9.3% of sales (Q2 2021: CHF 56 million, 9.0%).

Oerlikon Group 2022 Half-Year Overview

In the first half of 2022, the Group’s order intake increased by 21.2% year-on-year to CHF 1 563 million, and sales were up 19.7% to CHF 1 432 million. Operational EBITDA for the half year amounted to CHF 247 million, corresponding to a margin of 17.2%. Operational EBIT was CHF 135 million, or 9.4% of sales. EBITDA was CHF 237 million, or 16.6% of sales (HY 2021: CHF 200 million, 16.7%), and EBIT was CHF 125 million, or 8.7% of sales (HY 2021: CHF 95 million, 7.9%). The reconciliation of the operational and unadjusted figures can be found in the tables below.

1) All amounts (including totals and subtotals) have been rounded according to normal commercial practice. Thus, an addition of the figures presented can result in rounding differences.

The net result for the first half of the year increased by 23% to CHF 88 million, driven by EBITDA growth. As of June 30, 2022, Oerlikon had CHF 513 million of net debt, representing a net debt to operational EBITDA ratio of 1.0. Cash flow from operating activities for the first half of the year was CHF 22 million, compared to CHF 36 million in 2021, mainly due to the increase in inventories.

Division Overview

Surface Solutions Division

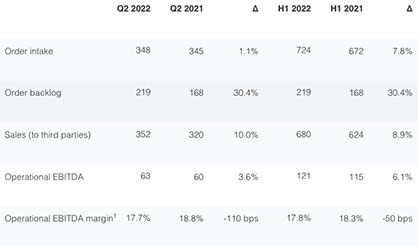

Key figures for the Surface Solutions Division as of June 30, 2022 (in CHF million)

1) Based on unrounded figures and total sales, including intercompany sales.

The Surface Solutions Division saw a 10% increase in sales, driven by general industries, energy and aviation. Automotive continued to be impacted by supply chain shortages, particularly in China and South Korea. Shortages are expected to moderate in the second half of the year. The division’s order intake slightly increased in the second quarter by 1% to CHF 348 million, while orders for the half year increased by 8% to CHF 724 million.

Q2 operational EBITDA improved by 3.6%, corresponding to a margin of 17.7%. The margin was impacted by transitory shortages in high-margin businesses, temporarily offsetting positive operating leverage and cost efficiency. Operational EBIT was CHF 24 million, or 6.8% of sales. EBITDA was CHF 61 million or 17.3% of sales (Q2 2021: CHF 62 million, 19.2%). EBIT was CHF 22 million, or 6.2% of sales (Q2 2021: CHF 20 million, or 6.1%).

Polymer Processing Solutions Division

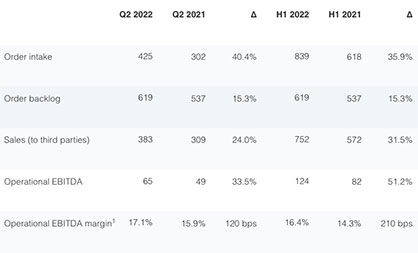

Key figures for the Polymer Processing Solutions Division as of June 30, 2022 (in CHF million)

1) Based on unrounded figures and total sales, including intercompany sales.

The Polymer Processing Solutions Division continued to grow profitably in the second quarter. Q2 2022 order intake increased by 40% to CHF 425 million. Sales increased by 24% to CHF 383 million year-over-year, driven by structural demand for filament equipment, flow control systems, plant engineering solutions and a recovery in demand in the U.S. carpet yarn market.

Operational EBITDA improved by 34% to CHF 65 million, or 17.1% of sales, driven by positive operating leverage, cost control and the INglass acquisition. Operational EBIT was CHF 51 million, or 13.3% of sales (Q2 2021: CHF 38 million, 12.2%). Second-quarter EBITDA was CHF 65 million, or 17.0% of sales (Q2 2021: CHF 49 million, 15.8%), and EBIT was CHF 50 million or 13.1% of sales (Q2 2021: CHF 38 million, 12.2%).