#Retail & Brands

adidas performs better than expected in transition year 2023

adidas CEO Bjørn Gulden:

“Although by far not good enough, 2023 ended better than what I had expected at the beginning of the year. Despite losing a lot of Yeezy revenue and a very conservative sell-in strategy, we managed to have flat revenues. We expected to have a substantial negative operating result, but achieved an operating profit of € 268 million. With a very disciplined go-to-market and buying process, we reduced our inventories by almost € 1.5 billion. With the exception of the US, we now have healthy inventories everywhere.

Maybe more important than the short-term financial KPIs are the improvements we achieved with the consumers and the retailers. We have launched and scaled some of the most popular footwear models in the market. Samba, Gazelle, Spezial, and Campus are selling very well and are also growing in all global web searches. We will continue to keep the momentum on these models, but also heat up and scale models like SL 72 and Superstar and launch new models in the lo profile and running lifestyle segment. We feel we are in a very good position to grow in the footwear lifestyle segment and expect this to also have a very positive effect on lifestyle apparel, especially collections with our famous Three Stripes.

On the Performance side, we have launched a lot of innovative products: The Adizero Adios Pro Evo 1 shoe, 138 grams light and probably the most innovative running shoe on the market, set the marathon world record with Tigist Assefa (2:11:58) and has won an unbelievable number of races. We are very proud of all our Adizero running products and expect to see further improvement in the running business, not only on the high end, but also in the commercial every-day-runner segment.

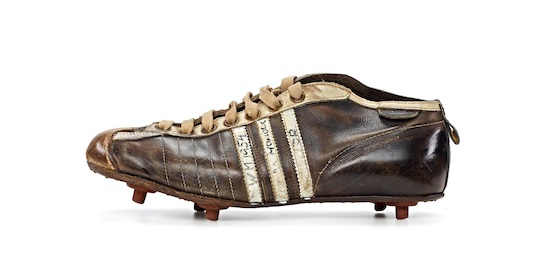

In Football, we have reinterpreted the famous Predator boot and just saw the most successful boot launch ever. Our Football business, in footwear, apparel, and accessories (including balls), is on a very positive trajectory. This will continue in 2024.

We already have a good Outdoor footwear business, but with the introduction of the Agravic Speed Ultra, we are confident to also be a major player in the trail running market.

The product for 2024 is good, our new marketing campaigns for both Originals and in Performance will continue to strengthen the brand. Our Sportswear business with clear takedown strategies will strengthen the distribution in the commercial channels in both wholesale and DTC.

In the fourth quarter, revenues in our DTC concept stores were up double digits, and the adidas full-price sell-out on our own e-commerce platforms was up 40%. Both indications that our new product is resonating well with the consumer.

I hear only positive feedback from our retail partners and believe they all plan to increase the adidas brand share in their businesses.

2024 will also be a great year to showcase our brand with the Olympics, Paralympics, EURO 24, Copa and all the other sports events. I really look forward to celebrating live sport with a lot of fans. I think a lot of people all over the world look forward to sport parties! This will also support our business.

We should see some growth already in Q1, but I expect growth to be stronger in the second half of the year.

We still have a lot of work to do, but I feel very confident we are on the right track. We will bring adidas back again. Give us some time and we will again say – we got this!”

FINANCIAL PERFORMANCE IN FY 2023

Currency-neutral revenues on prior-year level

In 2023, currency-neutral revenues were flat compared to the prior year. This was significantly better than the initially expected high-single-digit decline and also ahead of the company’s latest guidance provided in October, which had still projected a low-single-digit sales decline. This outperformance was driven by the accelerating momentum in the company’s underlying business. In addition, adidas also benefited from the sale of parts of the remaining Yeezy inventory. In euro terms, revenues declined 5% to € 21,427 million (2022: € 22,511 million). Reported revenues include the negative translation impact of more than € 1 billion from unfavorable currency movements, which are expected to continue to weigh on the company’s top-line development in 2024.

The top-line development in 2023 was impacted by significantly reduced sell-in to the wholesale channel as part of the company’s successful initiatives to reduce high inventory levels in the trade. In addition, the discontinuation of the Yeezy business represented a drag of around € 500 million on the year-over-year comparison during 2023. The sale of parts of the remaining Yeezy product in the second and third quarter positively impacted net sales by around € 750 million in 2023. This compares to a total of more than € 1,200 million of Yeezy revenues in 2022. Excluding the Yeezy revenues in both years, currency-neutral revenues grew 2% in 2023.

Mid-single-digit sales growth in footwear despite significant Yeezy impact

Despite the significant Yeezy impact, currency-neutral footwear sales were up 4% in 2023, reflecting strong double-digit growth in Football as well as in Specialist and US Sports. A high-single-digit increase in Originals also contributed significantly to the top-line improvement in footwear. Apparel revenues were down 6% on a currency-neutral basis, as this product category was particularly impacted by the high inventory levels in the marketplace and the company’s disciplined sell-in to the wholesale channel in response to it. Nevertheless, apparel revenues in Outdoor and Basketball grew at double-digit rates. Currency-neutral accessories sales were up 3%, mainly reflecting a double-digit increase in Football.

Iconic franchises create excitement across many categories

From a category perspective, currency-neutral revenues in Performance grew at a mid-single-digit rate in 2023. This growth was mainly driven by high-single-digit increases in Football, Outdoor, and Specialist Sports. The company benefited from strong momentum for many of its new product introductions, such as the latest iterations of its iconic Predator, X and Copa football boots. In addition, the next generation of the Terrex Free Hiker outdoor boots and newly launched versions of the Barricade tennis shoe resonated very well with the consumer. In Running, the Adizero product family in general and the introduction of the Adizero Adios Pro Evo 1 in particular led to record-breaking performances at marathon races around the world. This generated a lot of attention and strong demand for the entire franchise. As a result, the Adizero business grew more than 50% in 2023. Currency-neutral revenues in Lifestyle declined, reflecting the significant Yeezy impact. However, extraordinary demand and increasing supply for the company’s Samba, Gazelle, Spezial, and Campus franchises drove a mid-single-digit top-line improvement in Originals as well as double-digit growth in Skateboarding. In addition, adidas posted a double-digit sales increase in the Basketball category. Its newly introduced basketball apparel collection, the brand’s signature shoes with Anthony Edwards, James Harden, and Donovan Mitchell as well as the launch of its Fear of God product range in collaboration with Jerry Lorenzo generated excitement and demand amongst consumers.

Double-digit growth in own retail stores reflecting strong sell-out trends

As a result of the company’s initiatives to reduce high inventory levels, currency-neutral sales in wholesale declined 4% despite double-digit growth in Latin America and Greater China. At the same time, direct-to-consumer (DTC) revenues grew 3% versus the prior year. This development was driven by strong growth in adidas’ own retail stores (+12%) due to strong double-digit growth in all markets except North America. Growth was particularly strong in the company’s concept stores, reflecting the improving sell-out trends adidas has been experiencing for its current product range. The company’s e-commerce business declined 5% due to the Yeezy impact. In addition, adidas focused on reducing discounting activity and improving the overall business mix on its own online platforms. As a result, adidas full-price sales generated through the company’s own e-commerce activities increased at a strong double-digit rate, leading to significant improvements in the full-price share of the underlying adidas e-commerce business.

North America particularly impacted by Yeezy and conservative sell-in approach

From a market perspective, currency-neutral revenues in North America declined 16% as this market was particularly affected by the negative Yeezy impact as well as the company’s conservative sell-in strategy to reduce high inventory levels. Currency-neutral sales in Greater China were up 8%, driven by strong double-digit growth in both wholesale and adidas’ own retail stores. In EMEA, currency-neutral revenues were flat. A mid-single-digit increase in DTC, reflecting double-digit improvements in own retail, was offset by a decline in wholesale. Revenues in Asia-Pacific grew 7%, driven by double-digit growth in the company’s own distribution channels. In Latin America sales increased 22%, reflecting double-digit improvements in both wholesale and DTC.

Gross margin increased 0.2 percentage points to 47.5%

The company’s gross margin increased 0.2 percentage points to 47.5% in 2023 (2022: 47.3%). The improvement was mainly driven by a more favorable business mix and lower freight costs. This was largely offset by significant negative currency effects and increased product costs. In addition, while improving throughout the year, elevated discounting levels weighed on the gross margin development in 2023.

One-off costs drive increase in operating overhead expenses

Other operating expenses were down 2% to € 10,070 million in 2023 (2022: € 10,260 million). As a percentage of sales, other operating expenses increased 1.4 percentage points to 47.0% (2022: 45.6%). Marketing and point-of-sale expenses decreased 8% to € 2,528 million (2022: € 2,763 million) as the company limited investments at the point-of-sale when promotional activity in the marketplace was high. At the same time, the company continued to invest significantly into brand campaigns around major sporting events such as the FIFA Women’s World Cup, the Rugby World Cup, the Asian Games, or the Cricket World Cup. In addition, adidas connected with consumers through a large number of grassroots activities and ran a very successful Originals campaign during the second half of the year. The company supported new product introductions such as the latest iterations of its iconic footwear franchises in football, the Adizero Adios Pro Evo 1 in running, the first signature shoe launch with Anthony Edwards in basketball, as well as exclusive drops with partners such as Bad Bunny, Pharrell Williams, or Edison Chen in Lifestyle. Furthermore, adidas significantly broadened its portfolio of sports partners. New brand ambassadors include the Italian Football Federation, the Indian national cricket team, the National Olympic Committee of Poland, athletes like Rose Zhang, Gradey Dick, and Rome Odunze as well as a significant number of teams, federations, and individuals across a large number of sports categories. Operating overhead expenses increased 1% to € 7,541 million (2022: € 7,498 million). This includes one-off costs of around € 200 million related to the strategic review the company conducted in 2023, as well as donations and accruals for further donations in an amount of more than € 140 million. As a percentage of sales, operating overhead expenses increased 1.9 percentage points to 35.2% (2022: 33.3%).

Operating profit reaches € 268 million

The company’s operating profit reached € 268 million in 2023 (2022: € 669 million), reflecting an operating margin of 1.3% (2022: 3.0%). Compared to the initial guidance provided at the beginning of 2023, according to which the company was projecting an operating loss of € 700 million, the reported operating profit is around € 1 billion higher than initially expected. This outperformance was partly driven by a better operational business. In addition, the company’s decision to only write off a small portion of its remaining Yeezy inventory and sell a significant part of it in 2023 drove the better-than-expected operating profit development last year.

The sale of parts of the remaining Yeezy product in the second and third quarter positively impacted adidas’ operating profit by an amount of around € 300 million during 2023. At the same time, the company’s operating profit includes extraordinary expenses of more than € 340 million in total, reflecting one-off costs related to the strategic review the company conducted in 2023 (around € 200 million) as well as donations and accruals for further donations (more than € 140 million). adidas’ operating profit also includes a low-double-digit million euro amount of Yeezy-related inventory write-offs, reflecting the company’s decision to only write off a small portion of its remaining Yeezy inventory.

Tax rate extraordinarily high

Financial income doubled to € 79 million in 2023 (2022: € 39 million). This development mainly reflects higher interest income and changes in the fair value of financial instruments. Financial expenses were down 12% to € 282 million compared to € 320 million in 2022, mainly due to lower net foreign exchange losses. As a result, the company recorded a net financial result of negative € 203 million in 2023 (2022: negative € 281 million). The company’s tax rate increased to 189.2% in 2023 (2022: 34.5%). As a result of the significantly lower income before taxes, non-deductible expenses had a more significant impact on the tax rate than usual. In addition, the tax rate development reflects higher withholding taxes, which were not creditable and therefore had to be expensed. Going forward, the company expects the tax rate to normalize again as its operating profit improves.

Net loss from continuing operations of € 58 million

Net loss from continuing operations was € 58 million in 2023 (2022: net income of € 254 million), reflecting the extraordinarily high tax rate. Consequently, both basic and diluted earnings per share (EPS) from continuing operations reached negative € 0.67 (2022: € 1.25).

Average operating working capital as a percentage of sales of 25.7%

Inventories decreased by almost € 1.5 billion, or 24%, to € 4,525 million at the end of December 2023 (2022: € 5,973 million). The decrease was the direct result of the company’s successful initiatives around inventory management, including significantly reducing buying volumes and tactically repurposing existing inventory. On a currency-neutral basis, inventories decreased 22%. Accounts receivable decreased 25% to € 1,906 million at the end of December 2023 (2022: € 2,529 million). This development mainly reflects the company’s disciplined sell-in efforts to reduce inventory levels in the market as well as a more effective collection compared to the prior year. On a currency-neutral basis, receivables were down 23%. Accounts payable were down 22% to € 2,276 million at the end of December 2023 (2022: € 2,908 million). This development mainly reflects the lower sourcing volumes. On a currency-neutral basis, accounts payable decreased 21%. Average operating working capital as a percentage of sales increased 1.6 percentage points to 25.7% for the full year 2023 (2022: 24.0%), reflecting the slight increase of average operating working capital against the backdrop of lower net sales in 2023 compared to 2022.

Continuous investments into stores and digital

The company’s capital expenditure decreased 27% to € 504 million in 2023 (2022: € 695 million). Investments in new or remodeled own retail or franchise stores as well as shop-in-shop presentations of adidas products in customers’ stores represented almost half of the total. The remainder consisted mainly of investments in IT and logistics.

Executive and Supervisory Boards propose dividend payment of € 0.70 per share

The adidas AG Executive and Supervisory Boards will recommend paying a stable dividend of € 0.70 per dividend-entitled share to shareholders at the Annual General Meeting on May 16, 2024 (2023: € 0.70). This corresponds to a total payout of € 125 million, in line with the prior-year level (2023: € 125 million). The proposal reflects the company’s better-than-expected performance in the transition year 2023, its robust financial profile as well as Management’s confident outlook for the current year. Going forward, the company plans to return to its dividend policy of paying an annual dividend to shareholders in the range of 30% to 50% of net income from continuing operations.

FINANCIAL PERFORMANCE IN Q4 2023

Sales development significantly impacted by devaluation of the Argentine Peso

Currency-neutral revenues in the fourth quarter declined 2%, including a drag of around 5 percentage points related to the devaluation of the Argentine Peso. In addition, the lack of any Yeezy business weighed on the year-over-year comparison in an amount of around € 100 million. During the quarter, the company also continued its disciplined sell-in to the wholesale channel to reduce high inventory levels, particularly in North America. In euro terms, revenues declined 8% to € 4,812 million in Q4 (2022: € 5,205 million), including the negative translation impact of around € 300 million from unfavorable currency movements.

Double-digit growth in Originals and Skateboarding drives strong increase in footwear

Despite the significant Yeezy impact, currency-neutral footwear sales were up 8% in the fourth quarter driven by strong double-digit growth in Originals and Skateboarding. This development reflects the continued scaling of the adidas Samba, Gazelle, Spezial, and Campus franchises in light of very strong consumer demand. Apparel revenues declined 13% during the quarter, which was mainly the result of a significant decline in Football due to strong jersey sales in the prior year’s quarter related to the FIFA Football World Cup 2022. In addition, apparel sales continued to be impacted by elevated inventory levels, particularly in North America, and the company’s disciplined sell-in to the wholesale channel in response to it. Sales of accessories declined 1% in the fourth quarter, which was also mainly related to difficult comparisons with the prior year due to the FIFA Football World Cup in 2022.

From a channel perspective, the company’s top-line development in the fourth quarter reflects declines in both wholesale and DTC, which was both mainly related to declines in North America. Sales in adidas own retail stores increased 9%, reflecting double-digit improvements in EMEA, Greater China as well as Asia-Pacific. Across all regions, the strong growth in adidas’ own retail stores was driven by the company’s concept store fleet where sales grew at a double-digit rate in the fourth quarter. E-commerce revenues decreased 12% during the quarter due to the Yeezy impact. In addition, the company continued to successfully focus on reducing discounting in the channel. As a result, the full-price share of the underlying adidas business on the company’s own online platforms increased by around 10 percentage points compared to the prior year.

Strong double-digit growth in Greater China

Currency-neutral sales in North America decreased 21% reflecting disciplined wholesale sell-in and the company’s initiatives to clear excess inventory. In EMEA, revenues declined 7%, partly due to difficult comparisons with the prior year related to the FIFA Football World Cup 2022. However, double-digit growth across the company’s own retail stores shows the strong sell-out momentum the company experienced in the region in the fourth quarter. While overall sales were flat in Asia-Pacific, the company recorded double-digit growth in its DTC business. As a result of the significant devaluation of the Argentine Peso, currency-neutral sales in Latin America increased 1% driven by significant growth in DTC. Ultimately, Greater China posted a revenue increase of 37%, reflecting strong growth in both wholesale and own retail.

Gross margin increased 5.5 percentage points to 44.6%

In the fourth quarter of 2023, the gross margin increased by 5.5 percentage points to 44.6% (2022: 39.1%). This increase was driven by a better business mix, lower freight costs, as well as reduced discounting. In addition, lower inventory provisions contributed to the gross margin improvement. These positive developments were partly offset by significant unfavorable currency effects, higher product costs and the negative Yeezy impact.

Operating loss of € 377 million

Other operating expenses were down 10% to € 2,551 million during the fourth quarter (2022: € 2,825 million). As a percentage of sales, other operating expenses decreased 1.3 percentage points to 53.0% (2022: 54.3%). Marketing and point-of-sale expenses decreased 13% to € 666 million (2022: € 767 million) and as a percentage of sales were down to 13.8% (2022: 14.7%). Operating overhead expenses decreased 8% to € 1,885 million (2022: € 2,058 million). As a percentage of sales, operating overhead expenses decreased 0.4 percentage points to 39.2% (2022: 39.5%). During the quarter, the company recorded one-off costs of around € 50 million related to the strategic review the company had conducted in 2023. As a result, adidas recorded an operating loss of € 377 million (2022: operating loss of € 724 million), resulting in a negative operating margin of 7.8% (2022: negative operating margin of 13.9%). This includes a negative impact of around € 100 million related to the significant devaluation of the Argentine Peso in the fourth quarter. Net loss from continuing operations amounted to € 401 million in the quarter (2022: net loss from continuing operations of € 482 million). Both basic and diluted EPS from continuing operations were negative € 2.36 in the fourth quarter of 2023 (2022: negative € 2.69).

OUTLOOK FOR 2024

Currency-neutral sales to increase at a mid-single-digit rate in 2024

In 2024, macroeconomic challenges and geopolitical tensions are projected to persist. Against this backdrop, adidas plans to return to top-line growth by scaling its successful franchises, introducing new ones, and leveraging its significantly better, broader, and deeper product range. Improved retailer relationships, more impactful marketing initiatives, and the company’s activities around major sports events are also expected to contribute to the sales increase. As a result, the company expects currency-neutral sales to grow at a mid-single-digit rate in 2024. This top-line guidance assumes that adidas will sell the remaining Yeezy inventory at cost, which would result in sales of around € 250 million in 2024. This compares to Yeezy revenues of around € 750 million in 2023.

Underlying adidas business to grow at a double-digit rate in the second half

Excluding the Yeezy revenues in both years, the top-line guidance reflects currency-neutral growth at a high-single-digit rate in the underlying adidas business. The company expects the sales development to accelerate throughout the year, as growth in the first half will still be negatively impacted by initiatives to bring down elevated inventories in the North American market. In the second half of the year, the company projects the underlying adidas business to grow at a double-digit rate.

Underlying adidas business to grow significantly in almost all market segments in 2024

From a market perspective, currency-neutral revenues in the underlying adidas business – excluding the Yeezy revenues in both years – are expected to grow significantly in all markets except North America. Currency-neutral sales in North America are expected to decline at a mid-single-digit rate in 2024. This is mainly the result of the company’s continued disciplined sell-in to the wholesale channel during the first half of the year as part of its initiatives to reduce high inventory levels in this particular market. In contrast, adidas expects underlying revenues in Greater China and Latin America to grow at a double-digit rate in currency-neutral terms in 2024. Currency-neutral revenues in Europe, the Emerging Markets, and Japan/South Korea are expected to grow at a high-single-digit rate versus the prior-year level.

Operating profit of around € 500 million projected

Unfavorable currency effects are projected to weigh significantly on the company’s profitability in 2024, as they are expected to continue to adversely impact both reported revenues and the gross margin development. Taking the expected translational and transactional FX headwinds into account, adidas expects to generate an operating profit of around € 500 million in 2024. While the company continues to increase its marketing and sales investments, the top-line growth and an improving gross margin are projected to drive the bottom-line development in 2024. As the sale of the remaining Yeezy inventory is currently assumed to occur at cost, the sale of the product is expected to have no effect on the company’s operating profit this year.