Market Analysis & Forecasts

Tighter recycled fiber market revenue will reach USD 0.9 Bn in 2030, industry will embark on a sustainable growth journey

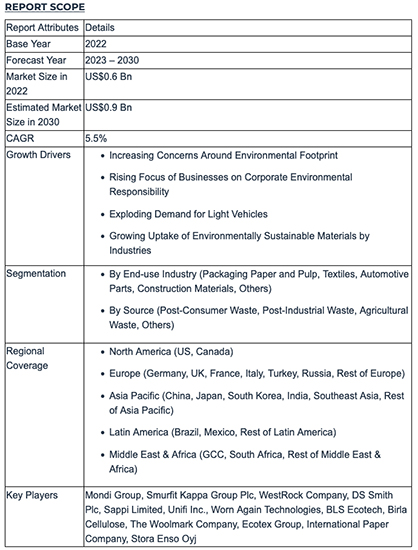

In a groundbreaking development, the global tighter recycled fiber market valued at US$0.6 Bn in 2022, is poised for exceptional growth, with projections reaching US$0.9 Bn by 2030. This anticipated surge underscores a robust CAGR of 5.5% during the forecast period from 2023 to 2030.

“As businesses, governments, and consumers align with the principles of circular economy models, the market for tighter recycled fiber is poised to play a pivotal role in shaping a greener and more sustainable future for the globe,” states the analyst at Fairfield, “Increasing consumer awareness and preferences for environmentally friendly and sustainable products are greatly responsible for driving the market ahead,” adding further.

The industry is projected to reap benefits from a cooperative effort extended by industries, governments, as well as consumers. The market's dynamism will be influenced by collaborative efforts to a large extent, among stakeholders to promote a resource-effective and sustainable circular economy.

Organisations, governments, and businesses are actively engaging in initiatives that contribute toward building a circular economic model, emphasizing the importance of reusing, recycling, and minimising waste across industries.

Key Research Insights

• Post-industrial waste will continue to be the most preferred source for tighter recycled fiber production.

• The automotive parts segment expects rapid growth throughout the forecast period.

• The category of recycled fiber derived from agricultural waste is expected to grow substantially throughout the forecast period.

Insights into Segmentation Analysis

Textile Sector Remains the Dominant Force, Followed by Automotive Parts

The textile sector maintains its dominance in the tighter recycled fiber market, aligning with the broader trend of sustainable practices in the fashion industry. Tighter recycled fiber serves as a greener substitute for traditional materials, addressing the environmental concerns associated with textile waste.

The automotive parts category is poised for significant growth as the automotive industry recognises the opportunity to create lighter, more environmentally sensitive vehicles by incorporating tighter recycled fiber in the production of automotive parts. This strategic move aligns with the industry's focus on reducing carbon emissions and implementing sustainable practices.

Post-industrial Waste – the Most Preferred Source

Post-industrial waste stands out as the preferred source for tighter recycled fiber. This category includes recycled fiber produced from manufacturing waste such as excess paper or production process scraps.

As businesses strive to minimise waste and embrace circular economy principles, post-industrial recycled fiber gains prominence as a sustainable solution.

The preference for post-industrial recycled fiber is grounded in the overarching goal of minimizing waste and adhering to circular economy principles. Businesses are increasingly recognizing the environmental benefits of sourcing recycled fiber from post-industrial waste.

Adoption of Agricultural Waste to See Substantial Growth Through 2030

The agricultural waste category is positioned for considerable growth during the forecast period. This category involves using plant and crop wastes, such as crop dregs, to produce recycled fiber.

Leveraging agricultural waste for tighter recycled fiber presents opportunities to reduce environmental impact and enhance resource efficiency, especially as sustainable agriculture practices gain traction.

As sustainable agriculture practices gain traction globally, the use of agricultural waste for tighter recycled fiber aligns with the broader commitment to environmental responsibility.

Key Report Highlights

• Modern consumers actively seek products with a smaller environmental footprint, motivating businesses to integrate tighter recycled fiber into their production processes to align with these evolving preferences.

• Innovations in recycling technologies have enhanced the viability and appeal of tighter recycled fiber, making it a sustainable and attractive option for producers seeking eco-friendly alternatives.

• Investments by governments, and the business sector play a crucial role in fortifying the recycling ecosystem, ensuring a consistent supply of higher-quality recovered fiber to meet the growing demands of the market.

Insights into Regional Analysis

Europe Dominant, Finds Government Support Instrumental

In terms of revenue share, Europe continued its dominance in the global market for tighter recycled fiber in 2022. The region's leadership is attributed to robust government backing, recycling initiatives, and adherence to environmental standards.

Organisations like the Trash and Resources Action Programme (WRAP) play a pivotal role in promoting recycling efforts. Italy, a renowned center for textile recycling, exemplifies Europe's commitment to sustainable practices, with businesses in Prato transforming old rugs and clothes into yarn.

Asia Pacific Poised for the Fastest Growth Pace

Asia Pacific is anticipated to exhibit the most rapid CAGR in terms of value in the global tighter recycled fiber market. The region's growth is fuelled by escalating concerns about the environmental effects of textile waste.

Government initiatives addressing textile waste management and the continuous development of cutting-edge technologies for textile recycling contribute to the region's rising demand for tighter recycled fiber.

Additionally, the expansion of e-Commerce and increasing consumer demand for environmentally friendly packaging further drive the adoption of tighter recycled fiber in the packaging and paper industries.

More info:

https://www.fairfieldmarketresearch.com/report/tighter-recycled-fiber-market