#Composites

SGL Carbon delivers strong first half of 2021 – transformation program and improving order situation show first successes

- Sales up 8.8% to €496.7 million compared with first half of previous year

- Adjusted EBITDA improves by 70.7% to €71.7 million

- Positive business development led to forecast increase on July 13, 2021

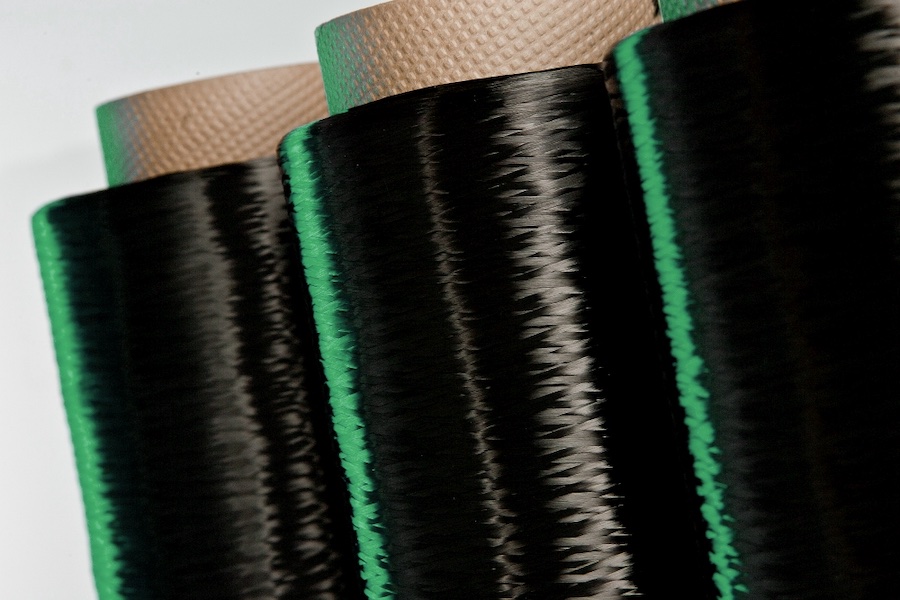

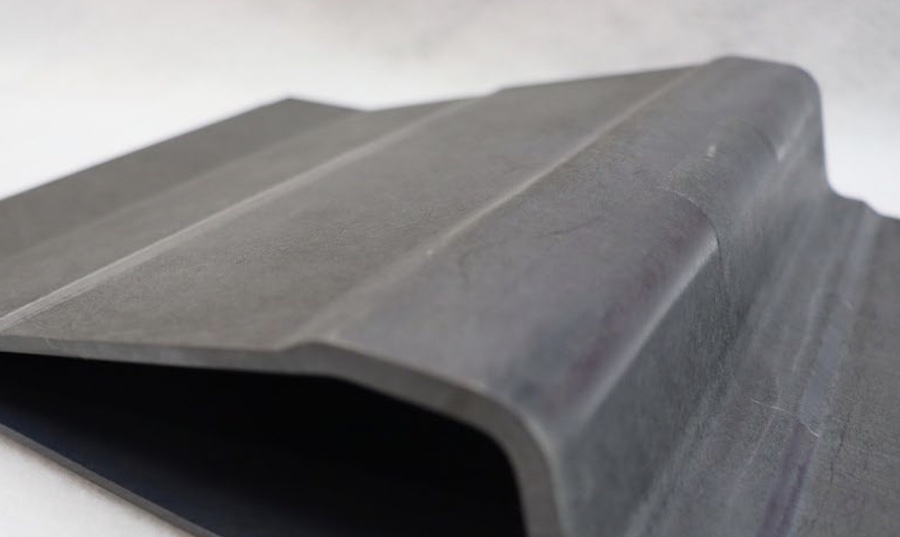

The Carbon Fibers and Composite Solutions Business Units particularly contributed to the €40.2 million increase in sales. Carbon Fibers contributed €166.4 million to Group sales, especially benefiting from increased demand from the automotive market segment. In the Composite Solutions Business Unit, the increase in sales of 52.4% to €60.2 million was also primarily based on the recovering demand from the automotive industry.

With sales of €221.2 million, the Graphite Solutions business area contributed around 44.5% of SGL Group sales. The 3.8% increase in the division's sales was particularly due to the positive development in the important markets of the LED, semiconductor and automotive industries.

Earnings situation:

SGL Carbon's adjusted EBITDA (adjusted for one-off effects and non-recurring items) improved by 70.7% to €71.7 million in the half-yearly comparison (H1 2020: €42.0 million). The improvement in earnings was due to higher capacity utilization as a result of higher sales and, in particular, the savings already achieved under the transformation program. However, higher purchase prices for raw materials, energy as well as transport and logistics had a negative impact on earnings, which could be compensated by savings resulting from other areas.

Adjusted EBITDA does not include one-off effects and non-recurring totaling minus €5.2 million. EBIT has also increased significantly to €38.3 million in the first half of 2021 compared to €5.7 million in the prior-year period. Apart from the positive effects mentioned above, the EBIT increase also results from the € 5.1 million decrease in depreciation and amortization to €28.2 million (H1 2020: €33.3 million) due to the impairments carried out at the end of 2020.

In consideration of the slightly improved financial result of minus €14.0 million (H1 2020: minus €15.8 million), the consolidated result for the first six months of the current financial year was positive at €17.9 million, compared with minus €13.8 million in the same period of the previous year (in each case after deduction of non-controlling interests of €0.2 million). Therefore, positive earnings per share of €0.15 could be reported again in the first half of 2021.

Net financial debt and equity:

SGL Carbon's net financial debt decreased by €39.8 million or 13.9% to €246.7 million as of June 30, 2021. Main reason for this development was the increase in liquidity by €42.5 million mainly based on the positive free cash flow of €56.5 million.

As of June 30, 2021, equity attributable to equity holders of the parent company increased by €56.1 million (+25.4%) to €276.8 million (December 31, 2020: €220.7 million). Accordingly, the equity ratio increased to 20.8% as of June 30, 2021 (December 31, 2020: 17.5%).

Transformation program:

The restructuring and transformation process initiated at SGL Carbon made a significant contribution to the Company's positive sales and earnings performance. In addition to leaner and more efficient structures as well as a reorganization of the business units with responsibility for results, a large number of improvements and cost initiatives in all business units and sites have contributed to the success of the ongoing transformation program.

Forecast increase:

Due to pleasing business development in the first half of the year as well as transformation successes, SGL Carbon raised its forecast for fiscal year 2021 on July 13, 2021. For the financial year 2021, the company now expects consolidated sales of around €1.0 billion (previously: €920 - 970 million). In line with developments in the first half of 2021 and the results from the transformation, adjusted EBITDA for 2021 is expected to be between €130 - 140 million (previously: €100 - 120 million). Accordingly, a slightly positive net profit is now forecasted for fiscal year 2021 (previously: €-20 million to €0).

Further details on business development and outlook can be found in the Group's interim report for the first half of 2021.