Associations

Global textile value chain: Between stagnation and uneven recovery

Regional performance varies dramatically

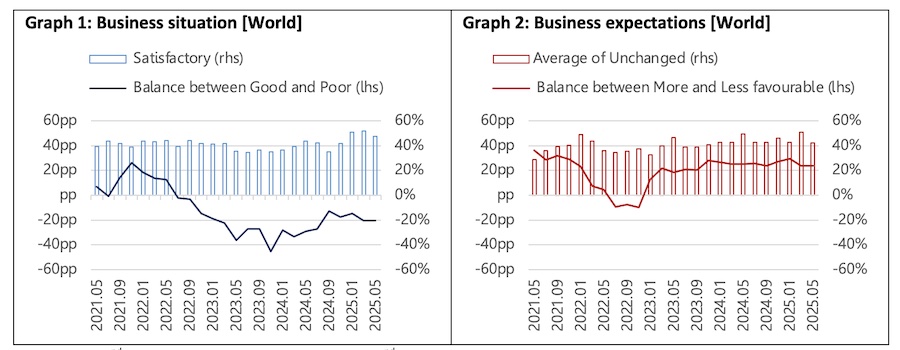

The survey shows a challenging global business situation with a -20 percentage point balance, but regional performance differs significantly. Africa emerges as the standout performer with a positive +23 pp balance, followed by South America at +6 pp. In contrast, East Asia faces significant challenges with a -48 pp balance. Looking ahead, the industry shows cautious optimism (+24 pp), with North America leading confidence at +65 pp and Africa at +54 pp, while East Asia remains negative at -18 pp.

Orders and capacity show mixed signals

Global order intake declined for four consecutive months since January, reaching -21 pp in May. Africa again leads with positive intake (+18 pp), while Europe (-45 pp) and East Asia (-41 pp) struggle most. Despite order challenges, global backlogs show modest recovery at 2.3 months. Textile capacity utilization reached 72% in May 2025. Asian markets continue to lead utilization rates, while upstream segments like spinning significantly outperform downstream operations.

Demand concerns dominate

Weak demand remains the primary concern for 61% of global participants over the next six months, with trade tensions and operational costs as secondary issues. Order cancellation rates remain stable and low across all regions.

For more information, please see http://www.itmf.org ;