#Raw Materials

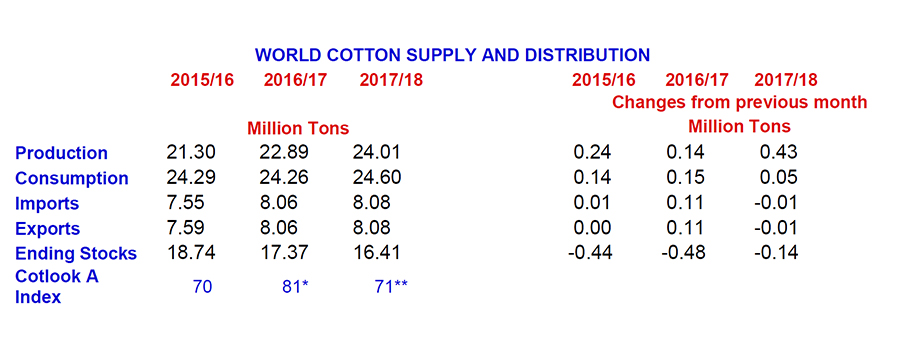

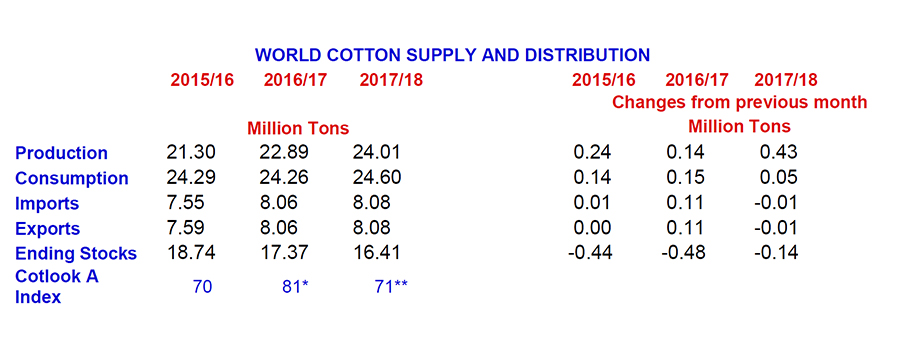

High prices persist despite rising stocks outside of China

** The price projection for 2016/17 is based on the ending stocks to mill use ratio in the world-less-China in 2015/16 (estimate), 2016/17

Global cotton production is projected to decline by 4% in the 2026/27 season to 24.8 million tonnes, while consumption is expected to remain relatively steady at 25.0 million tonnes, according to the March 2026 edition of Cotton This Month.

The International Cotton Advisory Committee (ICAC) is proud to announce that it has been included as a member of the European Commission’s Technical Advisory Board (TAB) on the Product Environmental Footprint methodology. The Commission developed the Product Environmental Footprint (PEF) to assess and communicate the life cycle environmental performance of products and organizations.

The Government of Uzbekistan has allocated 55,000 hectares of land to implement a regenerative agriculture program for cotton as part of a collaborative project with the International Cotton Advisory Committee (ICAC) and Bizpando, a company with a a blockchain-based internet platform designed to ensure supply chain compliance.

As we prepare to turn the calendar on 2025, world cotton lint production currently is estimated to be about 25.4 million tonnes — roughly the same as the last season — surpassing the world cotton lint consumption by 392,000 tonnes.

Cotton can do more – a lot more. Cutting-edge textiles and high-tech products made from 100% cotton prove just how powerfully performance and sustainability can come together. That very surge of innovation is front and centre at the 38th Bremen Cotton Conference, taking place March 25–27, 2026, at Bremen’s Parliament on the historic market square – culminating in a bold and dedicated closing session on Friday. In the spotlight: performance upgrades for pure cotton, smart strategies for circular textile waste solutions, and pioneering concepts for demanding technical applications. From natural fibre–reinforced composites to highly effective flame-retardant solutions, cotton steps out of the closet and shows the future potential woven into every fibre.

Esquel Group’s Xinjiang Research & Development Center has successfully developed two new Sea Island cotton (Extra-Long-Staple cotton, ELS cotton) varieties named “Yuan Loong 37” and “Yuan Loong 42,” which have been officially approved and granted registration numbers. Both varieties have also obtained Plant Variety Rights certificates, marking another significant breakthrough for the Group in cotton breeding and commercial application.

The Aid by Trade Foundation (AbTF) is reaching new milestones as it leads the way towards greater physical traceability for Cotton made in Africa® (CmiA) cotton. With around 700 suppliers and producers in a total of 25 countries, the Aid by Trade Foundation has reached a new record number of partners who can trace CmiA cotton from the product back to its origin. This is more than double the previous year’s figure.

The 38th International Cotton Conference Bremen will take place from 25 to 27 March 2026 at the Bremen Parliament. This conference has traditionally stood for in-depth expertise and international exchange. The program will focus on technical innovations, market trends, and regulatory frameworks across the entire value chain – from agriculture to the circular economy. With high-profile speakers, the conference is regarded as the key meeting point for the global cotton industry. Today’s focus: Cotton quality and testing methods.

With POY 2.0, Barmag is introducing a completely redesigned spinning concept that takes the production of partially oriented yarn (POY) to a new level in terms of technology and economy. The solution, which was presented to a selected audience of experts for the first time at ITMA Asia + CITME 2025, was met with great enthusiasm: several yarn producers worldwide immediately expressed their interest in a pilot plant.

As a highlight of the JEC, the Institut für Textiltechnik (ITA) of RWTH Aachen University will be presenting hydrogen pressure tanks manufactured using multifilament winding processes at the NRW joint booth in Hall 5, Stand G65.

DyStar, a leading specialty chemical company with a heritage of more than a century in product development and innovation, announced today the appointment of Ruan Cunfan to its Board of Directors, effective 20 February 2026.

Textile‑to‑textile recycling leader Circulose joins Spinnova’s ecosystem (consortium) to help advance the scale‑up of Spinnova’s technology. Spinnova has actively sought partners to accelerate commercial scale‑up, and Circulose, as a key player in textile recycling, strengthens the ecosystem by providing a raw material that is in high demand across the industry.