#Spinning

Second-quarter and half-year 2021 results

- Strong second quarter Group results with +23% in sales and +98% in operational EBITDA vs. prior year. Group operational EBITDA margin at 17.7%.

- Polymer Processing Solutions Q2 sales increased by 25% and operational EBITDA by 31% year-over-year, driven by strong execution. Operational EBITDA margin at 15.9%.

- Surface Solutions’ significant improvement in Q2 order intake of +45% and sales of +22% vs. prior year, mainly attributable to capturing business as demand picks up. Operational EBITDA margin improved to 18.8%.

- 2021 guidance increased, factoring in strong operating momentum in both Divisions, sustained cost-out benefits and acquisitions. 2021 sales expected to be around CHF 2.65 billion and operational EBITDA margin to be around 16.5%.

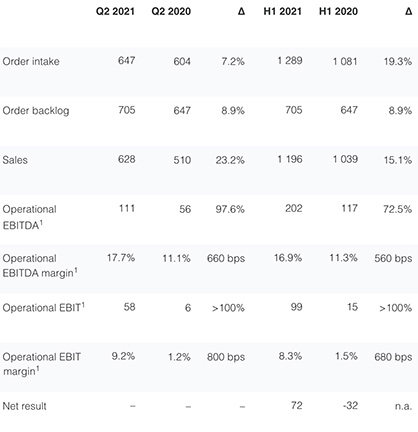

Key figures for the Oerlikon Group as of June 30, 2021

(in CHF million)

“We are pleased to deliver a strong second quarter and half-year peformance, confirming our strategy and the actions we took over the past two years,” said Dr. Roland Fischer, CEO Oerlikon Group.

“Surface Solutions continued to capture business as demand picks up, and the improved EBITDA margin underlines the continued positive effects from our cost actions. Polymer Processing Solutions saw healthy demand in both filament and non-filament businesses. Our strategic diversification in polymer processing, including flow control and sustainable recycling technologies, is expected to generate additional revenue opportunities in the coming years,” added Dr. Fischer.

“In view of our strong business momentum and the acquisitions of INglass and Coeurdor, we are increasing our guidance. We expect 2021 sales to be around CHF 2.65 billion (previously: CHF 2.35-2.45 billion), and the operational EBITDA margin to be around 16.5% (previously: 15.5%-16.0%),” concluded Dr. Fischer.

Strong Second Quarter

Group orders increased across all regions by 7.2% to CHF 647 million, and sales were up 23.2% to CHF 628 million, driven by recovery in Surface Solutions and higher demand in Polymer Processing Solutions. At constant exchange rates, Group sales increased by 22% to CHF 622 million.

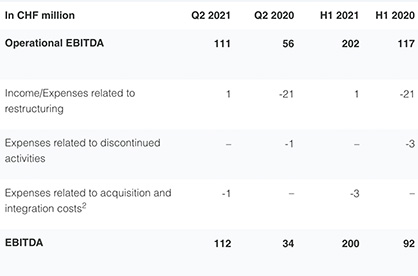

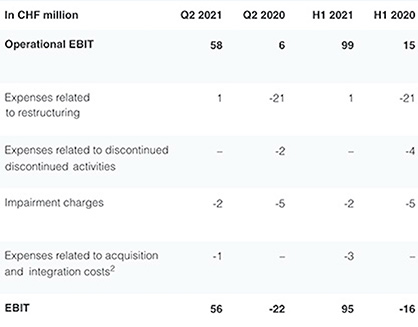

The operational EBITDA for the second quarter nearly doubled (+97.6%) to CHF 111 million, corresponding to a margin of 17.7%. The latter represents an increase of 660 basis points versus the prior year, driven by positive operating leverage and structural cost measures. Operational EBIT for Q2 2021 was CHF 58 million, or 9.2% of sales (Q2 2020: CHF 6 million, 1.2%). Q2 2021 EBITDA was CHF 112 million or 17.8% of sales (Q2 2020: CHF 34 million, 6.7%) and EBIT was CHF 56 million, or 9.0% of sales (Q2 2020: CHF -22 million, -4.2%).

Oerlikon Group 2021 Half-Year Overview

In the first half of 2021, the Group’s order intake increased by 19.3% year-on-year to CHF 1 289 million and sales were up 15.1% to CHF 1 196 million. Operational EBITDA for the half year amounted to CHF 202 million, corresponding to a margin of 16.9%. Operational EBIT was CHF 99 million, or 8.3% of sales. EBITDA was CHF 200 million, or 16.7% of sales (HY 2020: CHF 92 million, 8.9%), and EBIT was CHF 95 million, or 7.9% of sales (HY 2020: CHF -16 million, -1.5%). The reconciliation of the operational and unadjusted figures can be found in the tables below.

Table I: Reconciliation of Q2 2021 and H1 2021 operational EBITDA and EBITDA1

Table II: Reconciliation of Q2 2021 and H1 2021 operational EBIT and EBIT1

1All amounts (including totals and subtotals) have been rounded according to normal commercial practice. Thus, an addition of the figures presented can result in rounding differences. 2 Since Q2 2021, operational EBITDA and operational EBIT are additionally adjusted by acquisition and integration costs. For comparability, prior period figures have been adjusted accordingly. In addition, prior year figures have been adjusted retrospectively for activities that recently have been discontinued.

The net income for the first half of the year increased by CHF 104 million to CHF 72 million, driven by the improvement in EBITDA. As of June 30, 2021, Oerlikon had CHF 486 million of net debt, attributed to acquisitions and dividend payment. Cash flow from operating activities for the first half of 2021 was CHF 36 million, compared to CHF -5 million in 2020, due to the improved net result.

2021 Guidance Raised

In light of the strong business momentum, continued effectiveness of cost actions and the recent acquisitions, Oerlikon is increasing its 2021 guidance. Assuming markets continue to recover and there are no new major disruptions from the pandemic, the Group expects order intake for the full year to be around CHF 2.75 billion, sales to be around CHF 2.65 billion (previously: CHF 2.35-2.45 billion) and the operational EBITDA margin to be around 16.5% (previously: 15.5%-16.0%). In Polymer Processing Solutions, sales are expected to increase to around CHF 1.35 billion (previously: CHF 1.10-1.15 billion) and the operational EBITDA margin to be between 14.5%-15.0% (previously: ~14.0%). In Surface Solutions, sales are expected to be around CHF 1.3 billion (previously: CHF 1.25-1.30 billion) and the operational EBITDA margin to be between 18.0%-18.5% (previously: 16.5%-17.5%).

Division Overview

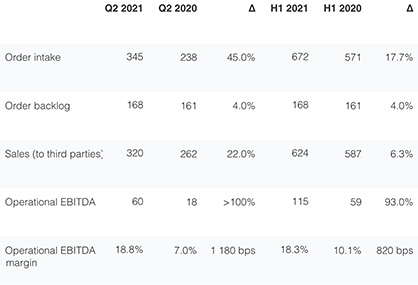

Surface Solutions Division

Key figures for the Surface Solutions Division as of June 30, 2021 (in CHF million)

Surface solutions markets, except aerospace and power generation, continued to recover across all regions in the second quarter. Automotive saw strong recovery in the first half of 2021 (Q2: +49% year-over-year) despite challenges with chip shortage. Tooling (Q2: +27% year-over-year) and general industries (Q2: +24% year-over-year) also noted improving trends. The Division succeeded in capturing business as demand returned. Order intake increased by 45% to CHF 345 million and sales increased by 22% to CHF 320 million. The significant year-over-year increase in order intake and sales was driven both by business improvements as well as recovery from the pandemic-impacted 2020 base.

Q2 operational EBITDA improved by ~230% and the EBITDA margin by 1 180 basis points, driven by positive operating leverage, cost control and business mix. Operational EBIT was CHF 20 million, or 6.2% of sales. EBITDA was CHF 62 million or 19.2% of sales (Q2 2020: CHF -4 million, -1.5%). EBIT was CHF 20 million or 6.1% of sales (Q2 2020: CHF -50 million, or -19.1%).

The successfully closed acquisition of Coeurdor in Q2 expands Oerlikon’s offering and foothold in the luxury goods market. Oerlikon has been offering innovative surface coatings applied in high-end deco, consumer and white goods. The addition of Coeurdor and its expertise opens up revenue opportunities in the growing luxury sector.

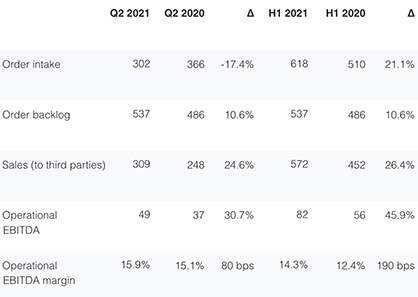

Polymer Processing Solutions Division

Key figures for the Polymer Processing Solutions Division as of June 30, 2021 (in CHF million)

The Polymer Processing Solutions Division delivered another strong quarter, driven by demand for filament and plant engineering solutions in China, including staple fibers and continuous polycondensation plants. The carpet yarn market in the U.S. noted initial signs of recovery in the second quarter. Q2 sales increased by 24.6% to CHF 309 million. The Q2 2021 order intake of CHF 302 million was 17.4% lower versus a record second quarter in 2020; first half 2021 order intake was up 21.1% over H1 2020.

Operational EBITDA increased by 30.7% to CHF 49 million, or 15.9% of sales, driven by operating leverage and the INglass acquisition. Operational EBIT was CHF 38 million, or 12.2% of sales (Q2 2020: CHF 30 million, 12.1%). Second-quarter EBITDA was CHF 49 million, or 15.8% of sales (Q2 2020: CHF 37 million, 15.1%) and EBIT was CHF 38 million or 12.2% of sales (Q2 2020: CHF 30 million, 12.0%).

The INglass acquisition, completed in the beginning of June 2021, accelerated Oerlikon’s strategy of diversifying its polymer processing business into non-filament areas, such as hot runners and engineering and consultancy services for developing advanced polymer processing products. This acquisition and other organic diversification efforts, such as sustainable recycling of polymers, are expected to generate additional revenues for Oerlikon in the coming years.