#Spinning

Oerlikon Manmade Fibers segment effectively navigated the challenges

Cost/Cash measures ahead of schedule; Manmade Fibers Segment on track despite pandemic

- Manmade Fibers Segment 1H order intake of CHF 510 million; 2020 delivery schedules on track.

- Surface Solutions Segment Q2 sales -31% year-over-year; COVID-19 pandemic significantly impacted all business lines. Swift cost actions executed to offset volume impact.

- Productivity program ahead of schedule; completed in 1H >400 of targeted 800 headcount reduction; on track to realize >700 reductions by year end. Expecting annual run-rate savings of CHF ~60 million.

- Program expected to yield further margin benefits in 2H2020 and in 2021.

- Group 1H operational EBITDA margin: 10.9%; EBITDA margin: 8.9%, including CHF 21.4 million of restructuring charges.

“Despite the pandemic, the Manmade Fibers Segment effectively navigated the challenges and saw a strong increase in orders, driven by a quick recovery in China and higher demand for nonwoven systems used to produce face masks,” added Dr. Fischer. “The Surface Solutions Segment experienced significant demand challenges due to the lockdowns. Toward the end of the quarter, we saw some encouraging signs of moderate recovery in automotive and precision components in China and Germany. The recovery of the economy and markets remains uncertain.”

“We have a strong cash position of CHF 600 million, a healthy balance sheet and expect to see improvements in margins and net liquidity in the second half of the year. We will continue implementing the structural programs to strengthen our cost and competitive market position and further invest in our sustainable innovations. We have the technology, liquidity and talents to take advantage of the upswing when markets turn around,” concluded Dr. Fischer.

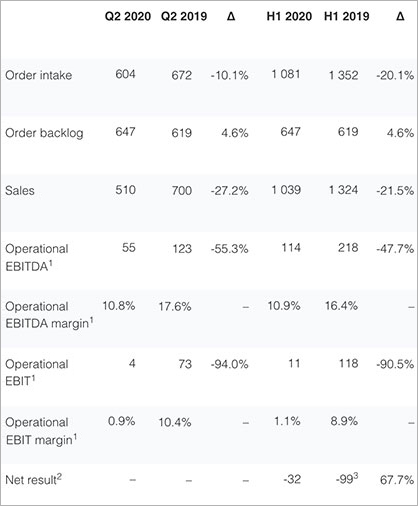

Key figures for the Oerlikon Group as of June 30, 2020 (in CHF million)

1) For the reconciliation of operational and unadjusted figures, please see table I and II on page 2 of this release. 2) Reported annually and semi-annually only. 3) Impacted by reclassification of CHF 284 million (non-cash) cumulative translation differences and other items from other comprehensive income related to the divestment of Drives Systems Segment.

In the second quarter of 2020, the global economy stalled with the COVID-19 pandemic outbreak. The lockdowns imposed by governments impacted the supply chain and demand across regions and industries, including the end markets of the surface solutions business, namely aviation, automotive, tooling and general industries, power generation and oil & gas.

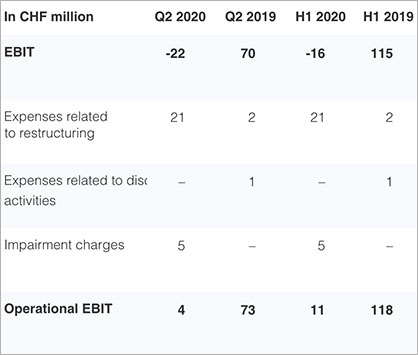

As a result of the pandemic and adverse currency movements, Group order intake decreased year-on-year by 10.1% to CHF 604 million and Group sales decreased by 27.2% to CHF 510 million. At constant exchange rates, sales were CHF 542 million, corresponding to a decline of 22.6% year-over-year. The operational EBITDA for the second quarter, excluding the restructuring charges, was CHF 55 million, corresponding to a margin of 10.8%. EBITDA was CHF 34 million, or 6.7% of sales. Operational EBIT for Q2 2020 was CHF 4 million, or 0.9% of sales and EBIT was CHF-22 million, or -4.2% of sales.

Oerlikon Group 2020 half-year overview

In the first half of 2020, the Group’s order intake declined by 20.1% year-on-year to CHF 1 081 million and sales decreased by 21.5% to CHF1 039 million. Operational EBITDA for the half-year amounted to CHF 114 million, corresponding to a margin of 10.9%. EBITDA, including CHF 21.4 million of restructuring charges, was CHF 92 million, or 8.9% of sales. Operational EBIT was CHF 11 million, or 1.1% of sales, while EBIT was CHF -16 million, or -1.5% of sales. The reconciliation of the operational and unadjusted figures can be found in the tables below.

Table I: Reconciliation of Q2 2020 and H1 2020 operational EBITDA and EBITDA(1)

Table II: Reconciliation of Q2 2020 and H1 2020 operational EBIT and EBIT(1)

1) All amounts (including totals and subtotals) have been rounded according to normal commercial practice. Thus, an addition of the figures presented can result in rounding differences.

The net result for the first half of the year was CHF -32 million. In the first six months of 2020, 37.0% of total Group sales (2019: 38.3%) were from the service business.

As of June 30, 2020, Oerlikon had CHF 600 million of cash and cash equivalents available to enable the company to meet ongoing challenges and to give it the ?exibility to execute on opportunities as they arise. Net liquidity on June 30, 2020 amounted to CHF -156 million. Cash flow from operating activities for the first half of 2020 was CHF -5 million, compared to CHF -11 million in 2019, due to an improvement in cash flow from changes in net current assets.

Accelerated restructuring and productivity programs

The execution of the comprehensive restructuring and productivity programs was accelerated and extended to mitigate the impacts caused by the COVID-19 pandemic.

Short-term measures such as short-time work and reducing discretionary spend and capital expenditures were implemented. In the first half of 2020, operating expenses was reduced by more than CHF 90 million and capital expenditure was reduced by CHF 18 million, compared to the preceding year.

The execution of the structural and cost-out programs that were launched in 2019 was sped up. The programs include optimizing support functions and the global footprint, leveraging synergies in procurement and equipment business, rightsizing additive manufacturing and addressing market challenges. More than 400 of the targeted 800 headcount reduction had been completed by the end of June 2020, and more than 700 headcount reductions are expected to be concluded by year end, of which around 50 are based in Switzerland and Liechtenstein. The structural programs are all on track and an annual run-rate of savings of around CHF 60 million is expected to be realized.

The short-term and structural programs are expected to yield significant margin benefits in the second half of the year. These programs will further strengthen the market position of the surface solutions business, improve its resilience to manage further potential pandemic-induced impacts and to cement its role as the reliable partner of choice for customers.

Remain committed to mid-term EBITDA margin target

The uncertainty caused by the pandemic and trade tensions are expected to continue impacting the economy, markets and their recovery. Oerlikon is continuing to execute its programs to strengthen its core and competitive position, while ensuring that the company is ready to capitalize on opportunities when markets turn around. Oerlikon remains committed to delivering on its mid-term target for the EBITDA margin of 16% to 18%.

Segment overview

Key figures for the Manmade Fibers Segment as of June 30, 2020 (in CHF million)

The Manmade Fibers Segment delivered a resilient performance despite the pandemic, driven by the recovery of the filament equipment business in China and a diversified portfolio in products such as nonwovens, staple fibers, polycondensation and smart factory solutions.

In the second quarter, a significant increase in order intake was recorded, attributed to a quick recovery in demand in China and the rest of Asia and the increasing demand for the nonwoven meltblown systems used in face mask production. The nonwoven market is anticipated to continue developing positively, as many countries strive to become more strategically autonomous for items deemed critical. For the half-year, the manmade Fibers business booked more than CHF 500 million in order intake and is on track to ful?ll its delivery schedules for 2020.

Sales declined by 22.8% in the second quarter, mainly due to the extraordinarily high sales volume in the second quarter of 2019. At constant exchange rates, sales declined by 17.7% to CHF 264 million. Sales in China were stable in the second quarter year-over-year, affirming the recovery in China from the shutdowns in the first quarter. The operational EBITDA for the second quarter declined by 34.9% to CHF 38 million, primarily attributed to the reduced sales volume. EBITDA was CHF 37 million, or 15.1% of sales (Q2 2019: CHF 57 million; 17.8%). Operational EBIT was CHF 30 million, or 12.1% of sales (Q2 2019: CHF 51 million; 16.0%). EBIT was CHF 30 million, or 12.1% of sales (Q2 2019: CHF 51 million; 15.7%).