#Spinning

Oerlikon Manmade Fibers Segment increased order intake and sales in 2019

- 5.3% increase in Group Q2 sales year-over-year

- Surface Solutions Segment noted lower Q2 top line and profitability due to market weakness as a result of global economic slowdown and uncertainties

- Manmade Fibers Segment sustaining strong quarterly performance

- Improved Group Q2 EBITDA margin: 17.3%

- Group first-half 2019 result from continuing operations: CHF 80 million

- Group first-half 2019 net result: CHF -99 million, including the negative CHF 284 million non-cash cumulative translation differences from Drive Systems Segment divestment

- Full-year guidance for 2019 adjusted as a result of lack of visibility of market recovery

“In the increasingly challenging market environment, we delivered a good performance for the second quarter and for the first half of 2019, driven by strong results of our manmade fibers business,” said Dr. Roland Fischer, CEO Oerlikon Group. “We increased Group sales and sustained operating profitability. Group orders came in slightly lower in the second quarter due to weak markets. The results underscore the resilience of our business while facing tough markets and confirm that we have a sound strategy and business model.”

“Economic growth around the world is stalling, resulting in lower investments in equipment and industrial production. These developments have impacted most of our end markets, from automotive to tooling and general industries, encompassing sectors such as semiconductors and electronics. While we still benefit from our structural growth initiatives, we have started to see weakening in our surface solutions business as reflected in the segment’s top line, margin and margin quality. Amid mounting geopolitical and market uncertainties, and given that the anticipated market recovery for our surface solutions business in the second half of the year is no longer visible, we are adjusting our guidance for 2019,” added Dr. Fischer. “Based on our reassessment, we expect to deliver around the same level of performance as for the full-year 2018.”

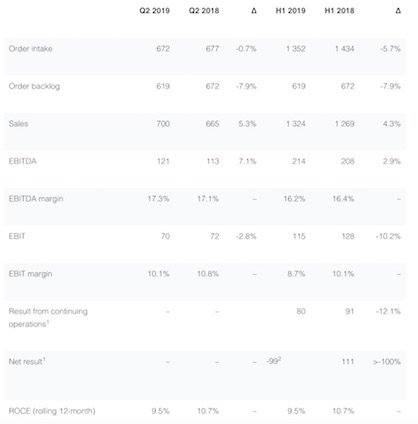

Oerlikon Group second quarter review

In the second quarter of 2019, the global economy further slowed down, exacerbated by drawn-out trade disputes. Significantly weaker-than-expected industrial production translated to lower volumes, and consequently reining in of investments for equipment and declining demand for services. These developments were registered across multiple markets, including automotive, tooling and general industries, and partly in aerospace.

Facing adverse market trends, the Group’s order intake slightly decreased year-on-year by 0.7% to CHF 672 million. However, the Group succeeded in increasing sales by 5.3% to CHF 700 million, underlining Oerlikon’s structural growth and resilient business model built on technology leadership in long-term attractive markets. At constant exchange rates, sales stood at CHF 720 million. EBITDA for the second quarter increased to CHF 121 million, corresponding to a margin of 17.3%. EBIT for Q2 2019 was at CHF 70 million, or 10.1% of sales. The second-quarter performance resulted in a rolling 12?month Oerlikon Group return on capital employed (ROCE) of 9.5%.

Oerlikon Group half-year overview

In the first half of 2019, the Group’s order intake declined year-on-year by 5.7% to CHF 1 352 million, primarily due to the record level of orders in the manmade fibers business in the first half of 2018. Sales came in 4.3% higher than the prior year, reaching CHF 1 324 million. With the increase in sales, the EBITDA for the half year amounted to CHF 214 million, corresponding to a margin of 16.2%. EBIT stood at CHF 115 million, or 8.7% of sales. The results from continuing operations for the half year came in at CHF 80 million – a 12% decrease year-over-year, primarily due to an increase in the cost of sales. The net result for the first half of the year was CHF -99 million, including the one-time non-cash reclassification of translation differences in the amount of CHF -284 Mio. and other items from other comprehensive income from the divestment of the Drive Systems Segment. In the first six months of 2019, Oerlikon’s service business contributed to 38.3% of total Group sales (2018: 39.0%).

As of June 30, 2019, Oerlikon had equity (attributable to shareholders of the parent) of CHF 1 798 million, representing an equity ratio of 48% (year end 2018: 44%). Net cash on June 30, 2019 amounted to CHF 380 million (year end 2018: CHF 398 million) after dividend payouts of CHF 1 per share and the repayment of a CHF 300 million Swiss bond. Cash flow from operating activities for the first half of 2019 decreased to CHF -11 million, compared to CHF 194 million in 2018, due to an increase in receivables and inventories, as well as a decrease in payables and contract liabilities.

Oerlikon Group

2019 outlook adjusted

Global economic slowdown is expected to prevail in the second half of 2019, with looming threats from geopolitical instabilities and concerns that trade disputes could intensify. Oerlikon’s key regional and end markets are exposed to these risks to a certain extent. Industrial activity and weakness in markets such as automotive, tooling and general industries are expected to further deteriorate, with no respite currently in sight. As a result, Oerlikon is adjusting its guidance. Despite the aforementioned environment, Group orders, sales and the EBITDA margin are projected to be sustained at around the same level as in 2018. Specifically, order intake is anticipated to reach up to CHF 2.7 billion, sales are to exceed CHF 2.6 billion and the EBITDA margin is to be around 15.5%.

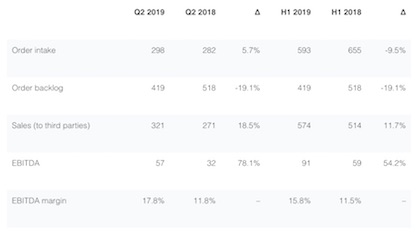

Manmade Fibers Segment

The Manmade Fibers Segment succeeded in sustaining its high level of performance – increasing order intake by 5.7% and sales by 18.5% in the second quarter. Sales in the second quarter represented the highest level of sales achieved by the segment since 2013. Sales growth was recorded primarily in textile applications such as filament equipment and texturing, and was substantiated by a healthy demand for systems used in industrial yarn spinning (special filament) and nonwovens (plant engineering). A decrease in demand for carpet yarn technologies was noted, which was a development to be expected following a very strong demand for these technologies in 2018.

Sales increased significantly in Europe (>140%), albeit from a low base, while China saw a healthy 26% growth. A decline in sales was registered in North America (-15%) and in India (-85%) compared to the second quarter of 2018.

The segment significantly improved operating profitability with an EBITDA margin of 17.8% for Q2 2019. This is attributed to disciplined cost management, a larger number of higher-margin projects in the mix and one-time customer effects. As a number of lower-margin projects from the down cycle and recovery periods are expected to be delivered and recognized in the second half of the year, the high EBITDA margin from the second quarter is not expected to be sustained in the upcoming quarters. EBIT for Q2 2019 stood at CHF 51 million (Q2 2018: CHF 26 million) and the EBIT margin was 15.7% (Q2 2018: 9.5%).

At the ITMA Barcelona show, the segment presented four world premieres in new and innovative industrial designs, partly combined with digital solutions. The eAFK Evo texturing system offers significantly higher production speeds, greater productivity and consistently high product quality, along with lower energy consumption and simpler operation. The segment also presented the latest member of its WINGS family FDY PA6 – these winders are able to smoothly handle fully drawn yarn (FDY) in the challenging polyamide 6 process. Also making its debut was Oerlikon Neumag’s BCF S8 Tricolor – a system that allows the production of more than 200 000 different color shades, superior spinning speed, 99% system efficiency and potential energy savings of up to 5% per kilogram of yarn. Last but not least, Oerlikon Barmag, in cooperation with its joint venture company BBEngineering, presented a clean technology solution called VacuFul – a vacuum filter that removes volatile contamination in spinning post-production.