#Retail & Brands

The H&M group gives a brief financial update on the ongoing Covid-19 situation

Reopenings in each market are in line with local restrictions and rules on social distancing. In those markets that have begun to open up, trade in the stores has initially been muted. At present 3,050 stores, representing 60 percent of the group’s 5,061 stores, are still temporarily closed.

The H&M group’s total sales during the period 1 March – 6 May this year decreased by 57 percent in local currencies compared with the same period in 2019. Online sales, which are open in 46 of the company’s 51 online markets, increased by 32 percent in the same period.

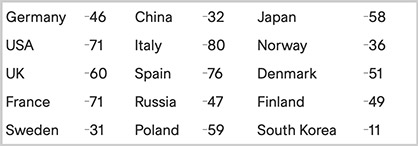

Sales development in some of H&M group markets during March 1 – May 6, in percent

To offset the negative sales development a range of rapid and forceful measures are being implemented in the areas of purchasing, investments, rents, staffing and financing. As at 30 April the stock-in-trade amounted to just above BSEK 41 (40).

Costs for markdowns are expected to decrease in absolute figures in the second quarter compared with the second quarter of 2019, but since sales will be significantly lower the markdowns are expected to have a negative effect on the gross margin of 2 – 4 percentage points. The assessment based on current information is still that operating expenses excluding depreciation and amortisation will be reduced by approximately 20-25 percent in the second quarter compared with the corresponding quarter 2019.

As communicated previously, the second quarter will be loss-making since the measures implemented will not compensate for the substantial drop in sales.

The H&M group’s liquidity is good. As at 30 April cash and cash equivalents plus unutilised credit facilities totalled BSEK 23,8. The group’s work is focused on ensuring financial flexibility and freedom of action on the best possible terms in a challenging market where business opportunities are also arising. The group is therefore working to secure additional credit facilities in parallel.