Raw Materials

Will early-season optimism be sustained?

Executive Summary

The August 2023 edition of Cotton This Month:

• Shows that initial projections for production, consumption and trade are improvements over the prior season

• However, there are already reasons for concern in three major producing countries

• Although consumption projections currently show an increase over 2022/23, it's likely to be revised downward, which will drag down trade numbers as well

But there are some concerning dark clouds on the horizon and those numbers are unlikely to be maintained, for a host of reasons:

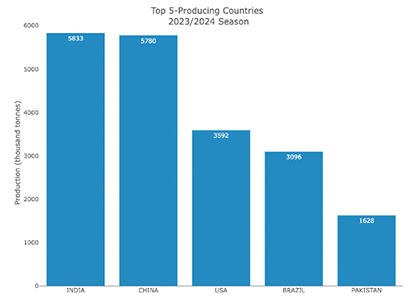

• Three of the world's top producers — China, India and the USA — are unlikely to hit their desired numbers, and the other two — Brazil and Pakistan — could struggle as well.

• Although global economic concerns like inflation have moderated significantly thanks to governments' efforts, consumer confidence remains low and that could drag down demand for discretionary goods.

• Lower demand means lower mill use, which means a decrease in trade.

For the most up-to-date statistics, please refer to the Data Dashboard.

https://icac.shinyapps.io/ICAC_Open_Data_Dashboaard/

It is updated with new data constantly and that new information is immediately reflected in the Dashboard, making it a valuable, up-to-date resource all month long. You can view a video tutorial on how to use the ICAC Data Dashboard on the ICAC’s YouTube page Here.

https://www.youtube.com/watch?v=Je6TEP5GPKY&t=723s

Price Projections

The Secretariat’s current price forecast of the season-average A index for 2023/24 ranges from 66 cents to 109 cents, with a midpoint of 85 cents per pound.