Yarn & Fiber

Lenzing achieves significant revenue and earnings growth within a deteriorating market environment

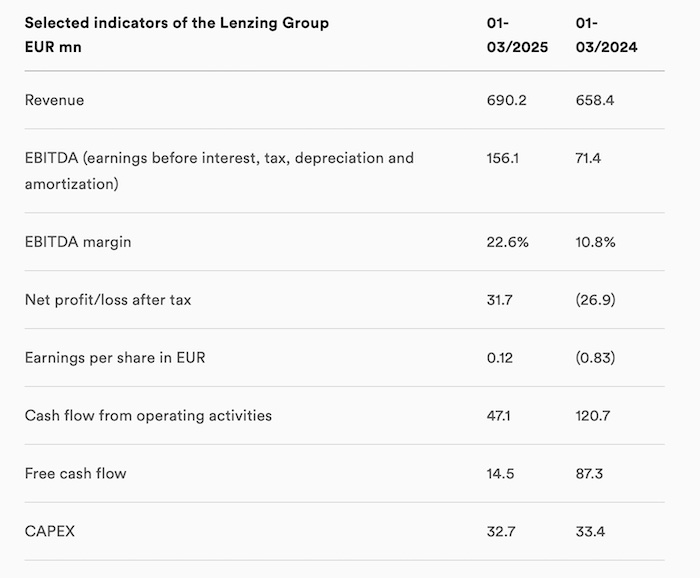

Revenue grew by 4.8 percent year-on-year to EUR 690.2 mn in the first quarter of 2025. The operating earnings trend largely reflected the positive effects of the performance program. Earnings before interest, tax, depreciation and amortization (EBITDA) rose by 118.8 percent year-on-year to EUR 156.1 mn. This also includes positive special effects from the sale of EUR 25.5 mn surplus EU emission certificates and the change in the fair value of biological assets in the amount of EUR 9.2 mn. The EBITDA margin in-creased from 10.8 percent to 22.6 percent. The operating result (EBIT) amounted to EUR 74.3 mn (compared with EUR 1.5 mn in the first quarter of 2024) and the EBIT margin amounted to 10.8 percent (compared with 0.2 percent in the first quarter of 2024). Earnings before tax (EBT) amounted to EUR 35.1 mn (compared with minus EUR 17.8 mn in the first quarter of 2024). The result after tax also improved significantly and was positive again for the first time since the third quarter of 2022 at EUR 31.7 mn (compared with minus EUR 26.9 mn in the first quarter of 2024).

“The Lenzing Group continued on its recovery track in the first quarter of 2025 and achieved significant revenue and earnings growth thanks to our performance program,” notes Rohit Aggarwal, Lenzing Group CEO. “Uncertainty in the markets and – as a consequence – limited earnings visibility have been further exacerbated by an increasingly aggressive tariffs policy. For this reason, we will not ease up on resolutely implementing the measures we have initiated, in order to complete our turnaround and further strengthen our position as a leading integrated fiber company.”

The Lenzing Group’s performance program is designed holistically with the overarching objective of significantly increasing long-term resilience to crises and greater agility in the face of market changes. The program initiatives are primarily aimed at improving EBITDA and at generating free cash flow through enhanced profitability, as well as sustainable cost excellence. Extensive actions are being undertaken to strengthen sales activities, such as the acquisition of new customers for the most important fiber types as well as expansion in previously smaller markets, which are exerting a positive impact in terms of revenue. The Managing Board also anticipates significant cost savings. Savings of over EUR 130 mn were already realized in the 2024 financial year. From the current financial year onwards, Lenzing is aiming for recurring annual cost savings of over EUR 180 mn.

Cash flow from operating activities amounted to EUR 47.1 mn in the first quarter of 2025 (compared with EUR 120.7 mn in the first quarter of 2024). Cash flow from investing activities amounted to minus EUR 36.1 mn (compared with minus EUR 32.8 mn in the first quarter of 2024). Free cash flow was also positive at EUR 14.5 mn (compared with EUR 87.3 mn in the first quarter of 2024). Cash flow from financing activities amounted to minus EUR 19 mn (compared with EUR 11.1 mn in the first quarter of 2024).

Liquid assets (including liquid bills of exchange) decreased slightly by 2.6 percent compared to December 31, 2024, to a level of EUR 439.9 mn as of March 31, 2025. Capital expenditure on intangible assets, property, plant and equipment and biological assets (CAPEX) amounted to EUR 32.7 mn in the first quarter of 2025 (compared with EUR 33.4 mn in the first quarter of 2024), reflecting the ongoing reduction in investment activities. In 2024, Lenzing focused clearly on maintenance and license-to-operate projects as part of its performance program, following significant investments in previous years.

Outlook

The IMF has significantly downgraded its growth forecasts for both this year and next to 2.8 percent and 3.0 percent respectively. The escalation of international trade conflicts and the risk of inflation returning are seen as major threats to global growth.[1]

In times of uncertainty and high living costs, consumers can be expected to remain cautious and thrifty, with negative effects on consumer sentiment and their willingness to spend.

The currency environment is expected to remain volatile in regions relevant to Lenzing.

In the trend-setting market for cotton, analysts expect a slight increase in stocks to around 18.8 mn tonnes in the current 2024/2025 harvest season, according to preliminary estimates.[2]

Lenzing will continue to consistently implement its performance program and expects to leverage further cost potentials and further improve its revenue and margin generation.

Having weighed the aforementioned factors, the Lenzing Group confirms its guidance for the 2025 financial year of year-on-year higher EBITDA.

However, the current tariff dispute and the high level of uncertainty associated with it are dampening expectations and further limiting the visibility of earnings.

In structural terms, Lenzing continues to expect growth in demand for environmentally responsible fibers for the textile and apparel industry, as well as for the hygiene and medical sectors. As a consequence, Lenzing is very well positioned with its strategy and is driving ahead with not only profitable growth in specialty fibers but also the further expansion of its market leadership in the sustainability area.

[1] Source: IMF, World Economic Outlook, April 2025

[2] Source: ICAC