#Nonwovens / Technical Textiles

Start of the year burdened by cost inflation and customer inventory issues, outlook updated

Suominen Corporation’s Interim Report for January 1 – March 31, 2022:

Start of the year burdened by cost inflation and customer inventory issues, outlook updated

Performance Share Plan: Ongoing performance periods

* Restated

In this financial report, figures shown in brackets refer to the comparison period last year if not otherwise stated.

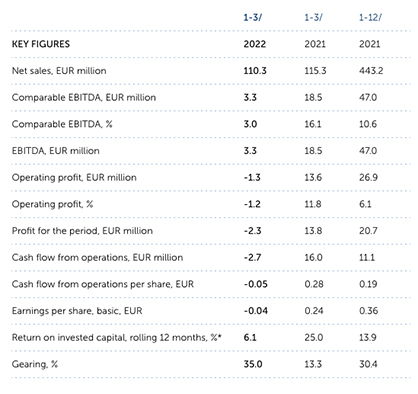

January–March 2022 in brief:

- Net sales decreased by 4% and amounted to EUR 110.3 million (115.3)

- Comparable EBITDA declined to EUR 3.3 million (18.5)

- Cash flow from operations was EUR -2.7 million (16.0)

Outlook for 2022 updated

Suominen expects that its comparable EBITDA (earnings before interest, taxes, depreciation and amortization) in 2022 will decrease clearly from 2021. The war in Ukraine has increased the already significant cost inflation in raw materials, energy and transportation. Also, while there has been progress in the normalization of the customer inventory levels in the US, it has been somewhat slower than expected. These factors will impact the full year result negatively even though we expect that the demand for our products will improve in the second half of the year. In 2021, Suominen’s comparable EBITDA was EUR 47.0 million.

Previous outlook

Suominen expects that its comparable EBITDA (earnings before interest, taxes, depreciation and amortization) in 2022 will decrease from 2021. The main reasons are inventory levels which still remain high at certain customers as well as operational issues in the entire supply chain due to the current COVID-19 situation, both of which will impact the result negatively especially in the first quarter. In 2021, Suominen’s comparable EBITDA was EUR 47.0 million.

Petri Helsky, President & CEO: “For Suominen the beginning of 2022 has been challenging as was expected. Certain key customers especially in the US continued to struggle with their inventory levels. Furthermore, in the early part of the year both our and our customers’ operations were affected by the omicron variant of the COVID-19. Both of these factors impacted our sales negatively. On the cost side we have seen further sharp increases in raw material, energy and freight costs. Due to the lag in our sales pricing mechanisms our pricing in the first quarter did not fully reflect these increases.

We condemn the Russian invasion of Ukraine and we feel deeply for all Ukrainians whose lives have been devastated by Russia’s incredulous aggression. The war has minor direct impact to Suominen’s business as we have had no suppliers in Russia, Belarus and Ukraine and only very few customers in Russia. Since the war started, we have stopped all sales to Russia. Suominen as a company is mostly affected by the indirect economic impacts of the invasion which contribute to the significant cost inflation mentioned above.

Our net sales were EUR 110.3 million (115.3) in the first quarter. Sales volumes decreased from the COVID-19 boom levels while sales prices increased clearly following the higher raw material prices. Our quarterly EBITDA was EUR 3.3 million (18.5). The main reasons for the decline were the lower volumes and the timing gap between our customer pricing and raw material, energy and freight costs which increased even more than the sales prices.

To improve our financial performance, we have launched an EBITDA improvement program to identify both new sales opportunities and cost savings initiatives. As an example of actions taken, we implemented an energy surcharge to all our products sold in Europe in mid-March. Also, as the inventory issues in the US are mainly related to a certain product group, we have been working to widen the product portfolio at the production lines especially affected by the inventory imbalance.

In line with our vision to be the frontrunner in sustainable nonwovens we are continuously developing our sustainable product offering. During the quarter, we launched our first carbon neutral product BIOLACE® Zero. Our efforts in the sustainability area were also recognized at the IDEA®22 Conference with our HYDRASPUN® Aquaflo winning the Nonwoven Product Achievement Award.

The near future continues to look challenging. The war in Ukraine has worsened the inflationary pressures in raw material, energy and freight costs and increased uncertainty overall. The inventory levels at our certain US key customers have remained elevated despite a decreasing trend supported by solid end consumer demand. However, we are more optimistic about the second half of the year. We are seeing signs of the raw material cost inflation moderating from the third quarter onwards and we also expect improved demand for our products through normalization of the US inventory levels and our portfolio widening actions mentioned above."

NET SALES

In January–March 2022, Suominen’s net sales decreased by 4% from the comparison period to EUR 110.3 million (115.3). Sales volumes decreased while sales prices increased following the higher raw material prices. Currencies impacted net sales positively by EUR 4.6 million.

Suominen has two business areas, Americas and Europe. Net sales of the Americas business area were EUR 61.7 million (71.9) and net sales of the Europe business area were EUR 48.5 million (43.4). ??EBITDA, OPERATING PROFIT AND RESULT??EBITDA (earnings before interest, taxes, depreciation and amortization) declined to EUR 3.3 million (18.5). This was driven by lower sales volumes and the timing gap between the higher raw material, energy and freight costs and sales pricing. The positive impact from currencies on EBITDA was EUR 0.6 million.

Operating profit decreased to EUR -1.3 million (13.6).??Result before income taxes was EUR -2.2 million (16.9), and result for the reporting period was EUR -2.3 million (13.8). In the comparison period, the sale of Amerplast impacted the result positively by EUR 3.7 million.

FINANCING

The Group’s net interest-bearing liabilities at nominal value amounted to EUR 53.8 million (20.2) at the end of the review period. The gearing ratio was 35.0% (13.3%) and the equity ratio 39.8% (43.9%).??In January–March, net financial expenses were EUR -0.9 million (+3.3), or -0.8% (2.8%) of net sales. The net financial expenses of the comparison period include a gain of EUR 3.7 million arising from the sale of Amerplast. Fluctuations in exchange rates decreased the net financial items by EUR 0.7 million. In the comparison period the fluctuations in exchange rates decreased the net financial items by EUR 0.7 million.

Cash flow from operations was EUR -2.7 million (16.0), representing a cash flow per share of EUR -0.05 (0.28). The decline in the cash flow from operations was mainly due to the lower result. An additional EUR 4.3 million was tied up in working capital (in Q1 2021: tied up additional EUR 2.2 million).

CAPITAL EXPENDITURE

The gross capital expenditure totaled EUR 1.8 million (5.2) and was mainly related to normal maintenance investments.

Depreciation and amortization for the review period amounted to EUR 4.6 million (4.9).

PROGRESS IN SUSTAINABILITY

We have strong focus on safety and accident prevention, and our long-term target is to have zero lost time accidents. In the first quarter there were no LTA’s at Suominen sites.

The employee-manager performance and development discussions, conducted in February–March, covered 98% of the white-collar employees. Our target is to develop and harmonize the performance and development process for our blue-collar employees globally.

We are committed to continuously improving our production efficiency and the efficient utilization of natural resources. In the first quarter we continued our active measures towards our targets to reduce energy consumption, greenhouse gas emissions, water consumption and waste to landfill by 20% per ton of product by 2025 compared to the base year of 2019. As an example of our concrete actions to reduce greenhouse gas emissions we installed solar panels to our Alicante plant during the first quarter of the year.

We offer a comprehensive portfolio of sustainable nonwovens to our customers and we are continuously developing new and innovative solutions with a reduced environmental impact. During the first quarter of 2022 we launched our first carbon neutral product BIOLACE® Zero. Our target is a 50% increase in sales of sustainable nonwovens by 2025 compared to 2019, and to have over 10 sustainable product launches per year.

Suominen reports progress in its key sustainability KPIs annually.

As part of our Annual Report 2021 published on March 2, 2022 we reported on the progress of our sustainability performance. Our sustainability reporting in 2021 was done in accordance with the Core option of the GRI Standards from the Global Reporting Initiative and it was assured by an external partner.

INFORMATION ON SHARES AND SHARE CAPITAL

Share capital

The number of Suominen’s registered shares was 58,259,219 shares on March 31, 2022, equaling to a share capital of EUR 11,860,056.00.

Share trading and price

The number of Suominen Corporation shares traded on Nasdaq Helsinki from January 1 to March 31, 2022 was 7,195,433 shares, accounting for 12.6% of the average number of shares (excluding treasury shares). The highest price was EUR 5.27, the lowest EUR 3.02 and the volume-weighted average price EUR 3.85. The closing price at the end of review period was EUR 3.55. The market capitalization (excluding treasury shares) was EUR 204.0 million on March 31, 2022.

Treasury shares

On March 31, 2022, Suominen Corporation held 797,077 treasury shares. As a share-based payment plan vested, in total 237,584 shares were transferred to the participants of the plan in February.

The share repurchase program of Suominen commenced on November 3, 2021 and ended on January 21, 2022. Suominen acquired in total 68,677 shares in January 2022

The portion of the remuneration of the members of the Board of Directors which shall be paid in shares

The Annual General Meeting held on March 24, 2022 decided that 75% of the annual remuneration of the members of the Board of Directors is paid in cash and 25% in Suominen Corporation’s shares.

The shares will be transferred out of the own shares held by the company by the decision of the Board of Directors within two weeks from the date on which the interim report of January–March 2022 of the company is published.

Share-based incentive plans for the management and key employees

The Group management and key employees participate in the company’s share-based long-term incentive plans. The plans are described in more detail in the Financial Statements and in the Remuneration Report, available on the company’s website www.suominen.fi.

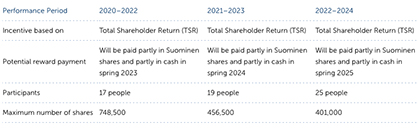

Company's Performance Share Plan currently includes three 3-year performance periods, calendar years 2020–2022, 2021–2023 and 2022–2024. The aim of the Performance Share Plan is to combine the objectives of the shareholders and the persons participating in the plan in order to increase the value of the company in long-term, to build loyalty to the company and to offer them competitive reward plans based on earning and accumulating the company’s shares.

Performance Share Plan: Ongoing performance periods

The President & CEO of the company must hold 50% of the net number of shares given on the basis of the plan, as long as his or her shareholding in total corresponds to the value of his or her annual gross salary. A member of the Executive Team must hold 50% of the net number of shares given on the basis of the plan, as long as his or her shareholding in total corresponds to the value of half of his or her annual gross salary. Such number of shares must be held as long as the participant’s employment or service in a group company continues.

ANNUAL GENERAL MEETING

The Annual General Meeting (AGM) of Suominen Corporation was held on March 24, 2022.

The AGM adopted the Financial Statements and the Consolidated Financial Statements for the financial year 2021 and discharged the members of the Board of Directors and the President & CEO from liability for the financial year 2021. The AGM approved the Remuneration Report for the governing bodies.

The AGM decided, in accordance with the proposal by the Board of Directors, that a dividend of EUR 0.20 per share will be paid.

The AGM confirmed the remuneration of the Board of Directors. The Chair will be paid an annual fee of EUR 70,000 and the Deputy Chair and other Board members an annual fee of EUR 33,000. Chair of the Audit Committee will be paid an additional fee of EUR 10,000. Further, the members of the Board will receive a fee for each Board and Committee meeting as follows: EUR 500 for each meeting held in the home country of the respective member, EUR 1,000 for each meeting held elsewhere than in the home country of the respective member and EUR 500 for each meeting held as a telephone conference.

75% of the remuneration is paid in cash and 25% in Suominen Corporation’s shares. Compensation for expenses is paid in accordance with the company's valid travel policy.

The AGM decided that the number of Board members remains unchanged at six (6). Mr. Andreas Ahlström, Mr. Björn Borgman, Mr. Jaakko Eskola, Ms. Nina Linander and Ms. Laura Raitio were re-elected as members of the Board. Mr. Aaron Barsness was elected as a new member of the Board.

Mr. Jaakko Eskola was re-elected as the Chair of the Board of Directors.

Ernst & Young Oy, Authorised Public Accountant firm, was re-elected as the auditor of the company for the next term of office in accordance with the Articles of Association. Ernst & Young Oy appointed Mr. Toni Halonen, Authorised Public Accountant, as the principally responsible auditor of the company.

The AGM authorized the Board of Directors to decide on the repurchase of the company’s own shares and to resolve on the issuance of shares and granting of options and the issuance of special rights entitling to shares. The terms and conditions of the authorization are explained later in this interim report.

Suominen published a stock exchange release on March 24, 2022 concerning the resolutions of the Annual General Meeting and the organizing meeting of the Board of Directors. The stock exchange release and an introduction of the new Board member can be viewed on Suominen’s website at www.suominen.fi.

In compliance with the resolution of the Annual General Meeting, on April 7, 2022 Suominen paid out dividends in total of EUR 11.5 million for 2021, corresponding to EUR 0.20 per share.

Organizing meeting and permanent committees of the Board of Directors

In its organizing meeting held after the AGM, the Board of Directors elected Andreas Ahlström as Deputy Chair of the Board.

The Board of Directors elected from among its members the members for the Audit Committee and Personnel and Remuneration Committee. Nina Linander was re-elected as the Chair of the Audit Committee and Andreas Ahlström and Laura Raitio were re-elected as members. Jaakko Eskola was re-elected as the Chair of the Personnel and Remuneration Committee and Björn Borgman was re-elected as member, and Aaron Barsness was elected as new member.

Authorizations of the Board of Directors

The Annual General Meeting (AGM) held on March 24, 2022 authorized the Board of Directors to decide on the repurchase a maximum of 1,000,000 of the company’s own shares. The company’s own shares shall be repurchased otherwise than in proportion to the holdings of the shareholders by using the non-restricted equity through trading on regulated market organized by Nasdaq Helsinki Ltd at the market price prevailing at the time of acquisition. The shares shall be repurchased and paid in accordance with the rules of Nasdaq Helsinki Ltd and Euroclear Finland Ltd. The shares shall be repurchased to be used in company’s share-based incentive programs, in order to disburse the remuneration of the members of the Board of Directors, for use as consideration in acquisitions related to the company’s business, or to be held by the company, to be conveyed by other means or to be cancelled. The Board of Directors shall decide on other terms and conditions related to the repurchase of the company’s own shares. The repurchase authorization shall be valid until June 30, 2023 and it revokes all earlier authorizations to repurchase company’s own shares.

The Annual General Meeting (AGM) held on March 24, 2022 authorized the Board of Directors to decide on issuing new shares and/or conveying the company’s own shares held by the company and/or granting options and other special rights referred to in Chapter 10, Section 1 of the Finnish Companies Act. New shares may be issued, and the company’s own shares may be conveyed to the company’s shareholders in proportion to their current shareholdings in the company; or by waiving the shareholder’s pre-emption right, through a directed share issue if the company has a weighty financial reason to do so, such as, for example, using the shares as consideration in possible acquisitions or other arrangements related to the company’s business, as financing for investments, using shares as part of the company’s incentive program or using the shares for disbursing the portion of the Board members’ remuneration that is to be paid in shares. The new shares may also be issued without payment to the company itself. New shares may be issued and/or company’s own shares held by the company or its group company may be conveyed at the maximum amount of 5,000,000 shares in aggregate.

The Board of Directors may grant options and other special rights referred to in Chapter 10, Section 1 of the Finnish Companies Act, which carry the right to receive against payment new shares or own shares held by the company. The right may also be granted to the company’s creditor in such a manner that the right is granted on condition that the creditor’s receivable is used to set off the subscription price (“Convertible Bond”). However, options and other special rights referred to in Chapter 10, Section 1 of the Companies Act cannot be granted as part of the company’s remuneration plan.

The maximum number of new shares that may be subscribed and own shares held by the company that may be conveyed by virtue of the options and other special rights granted by the company is 5,000,000 shares in total which number is included in the maximum number stated above.

The authorizations shall revoke all earlier authorizations regarding share issue and issuance of special rights entitling to shares. The Board of Directors shall decide on all other terms and conditions related to the authorizations. The authorizations shall be valid until June 30, 2023.

NOTIFICATIONS UNDER CHAPTER 9, SECTION 5 OF THE SECURITIES MARKET ACT

March 8, 2022: The shareholding of Etola Group Oy, controlled by Mr. Erkki Etola, in Suominen Corporation crossed the 10% flagging threshold. At the same time the total holding of Erkki Etola and companies controlled by him in Suominen Corporation crossed the 20% flagging threshold.

February 25, 2022: The shareholding of Etola Group Oy, controlled by Mr. Erkki Etola, in Suominen Corporation crossed the 5% flagging threshold.

January 20, 2022: The shareholding of Ilmarinen Mutual Pension Insurance Company in Suominen Corporation fell below the threshold of 5%.

SHORT TERM RISKS AND UNCERTAINTIES

The raw material, energy and logistics markets relevant for Suominen continue to experience significant volatility and cost inflation. This can impact Suominen’s financial performance depending on how the markets develop.

Regarding the war in Ukraine, the direct impact to Suominen’s business is minor as we have very few customers and no suppliers in Russia, Belarus and Ukraine. Suominen as a company is mostly affected by the indirect economic impacts of the war which contribute to the cost inflation mentioned above.

Also the COVID-19 pandemic can still cause uncertainty in Suominen’s business environment. The key risks related to the virus concern the health and safety of Suominen personnel and customers, possible shortages of raw materials and issues linked to logistics, as well as potential closures of customers’ or our own plants due to virus infections. Our customers have generally performed well financially even during the pandemic and thus our customer credit risks have not materially increased. ?Suominen’s other risks and uncertainties include but are not limited to: risks related to manufacturing, competition, raw material prices and availability and customer specific volumes and credits, changes in legislation, political environment or economic conditions and investments, and financial risks.

A more detailed description of risks is available in Suominen’s Annual Report 2021 at suominen.fi/investors.

BUSINESS ENVIRONMENT

Suominen’s nonwovens are, for the most part, used in daily consumer goods, such as wet wipes as well as in hygiene and medical products. In these target markets of Suominen, the general economic situation determines the development of consumer demand, even though the demand for consumer goods is not very cyclical in nature. North America and Europe are the largest market areas for Suominen. In addition, the company operates in the South American markets. The growth in the demand for nonwovens has typically exceeded the growth of gross domestic product by a couple of percentage points.

The market expectation is that in the long run the end user demand for wipes will remain above pre-COVID levels. However, the pandemic-caused demand spike followed by moderation of said demand has led to an inventory imbalance in the whole supply chain especially in the US which still partially persists.

The war in Ukraine has worsened the inflationary pressures in raw material, energy and freight costs and increased uncertainty overall. However, we are seeing signs of the raw material cost inflation moderating from the third quarter onwards and we also expect normalization of the US inventory levels going forward.

OUTLOOK FOR 2022

Suominen expects that its comparable EBITDA (earnings before interest, taxes, depreciation and amortization) in 2022 will decrease clearly from 2021. The war in Ukraine has increased the already significant cost inflation in raw materials, energy and transportation. Also, while there has been progress in the normalization of the customer inventory levels in the US, it has been somewhat slower than expected. These factors will impact the full year result negatively even though we expect that the demand for our products will improve in the second half of the year. In 2021, Suominen’s comparable EBITDA was EUR 47.0 million.

CORPORATE GOVERNANCE STATEMENT AND REMUNERATION REPORT

Suominen has prepared a separate Corporate Governance Statement and a Remuneration Report for?2021, which comply with the recommendations of the Finnish Corporate Governance Code for listed?companies. The statements also cover other central areas of corporate governance. The statements have been published on Suominen's website, separately from the Report of the Board of Directors, at http:/www.suominen.fi

Interim Report

https://www.suominen.fi/newsroom/2022/suominen-corporations-interim-report-for-january-1--march-31-2022-start-of-the-year-burdened-by-cost-inflation-and-customer-inventory-issues-outlook-updated/