#Composites

SGL Carbon continues dynamic business development in Q1 2022

- Low impact of Ukraine war on business performance in 1st quarter

- 12.2% increase in sales to €270.9 million based on growth in all four business units

- Adjusted EBITDA improves by 11.5% to €36.8 million

Sales development

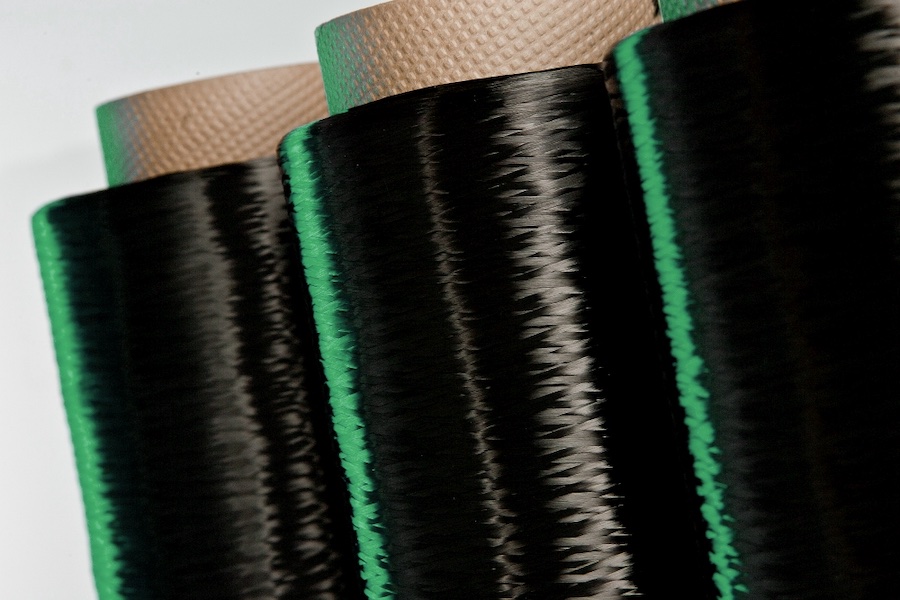

In the first three months of fiscal 2022, the sales increase of €29.4 million was driven by all four operating business units: Graphite Solutions (+€11.3 million), Carbon Fibers (+€6.6 million), Composite Solutions (+€7.2 million) and Process Technology (+€6.0 million).

In particular, sales to customers in the automotive and semiconductor industries and a significant recovery in the industrial applications segment were key factors in the increase in sales. Sales of the Process Technology business unit to customers in the chemical industry also developed pleasingly. The effects of the war in Ukraine, which has been ongoing since the end of February 2022, had only a little impact on SGL Carbon's sales performance in the 1st quarter.

Earnings development

Despite the increasingly difficult market environment in the course of Q1 2022, associated with temporary supply and production bottlenecks at the customers, temporarily interrupted transport routes, and significantly higher energy prices, SGL Carbon was able to keep the adjusted EBITDA margin almost stable year-on-year at 13.6%.

Adjusted EBITDA increased by 11.5% to €36.8 million in the reporting period. Higher capacity utilization in the business units and product mix effects contributed to the improvement in earnings, together with the cost savings achieved as a result of the transformation. By contrast, higher raw material, energy and logistics costs as of end of February 2022 had a negative impact on earnings. The Carbon Fibers business unit was particularly affected by the energy price increases. One-time expenses of €9.2 million in conjunction with energy transactions burdened the Carbon Fibers business unit in the 1st quarter of 2022.

To secure the production and delivery capabilities, around 85% of the energy requirements of the entire SGL Carbon for 2022 are price-hedged.

Adjusted EBITDA and EBIT do not include in total positive one-time effects and special items of €8.5 million, among other things from the termination of a heritable building right to a site no longer in use. Taking into account the one-time effects and special items presented as well as depreciation and amortization of €14.1 million, reported EBIT increased by 83.5% to €31.2 million (Q1 2021: €17.0 million). The net profit for the period developed correspondingly and more than tripled from €6.1 million to €21.4 million in a quarter-on-quarter comparison.

Outlook

The sales and earnings figures for the 1st quarter 2022 confirm the stable demand from the market segments. Price increases and volatility in the availability of raw materials, transportation services and energy were largely offset by savings from the transformation program and pricing initiatives at SGL Carbon's customers.

For 2022, SGL Carbon continues to expect volatile raw material and energy prices, which were included in the forecast for 2022 at the time of planning. However, there are uncertainties about the extent and duration to which SGL Carbon and its customers will be affected by the impact of the war in Ukraine or temporary supply chain disruptions due to the lockdowns in China. Therefore, SGL Carbon's outlook for fiscal 2022 does not include supply and/or production interruptions at its customers or the impact of a possible energy embargo that cannot be estimated at this time.

The forecast also implies that factor cost increases can be at least partially passed on to the customers through pricing initiatives. SGL Carbon has also included the revenue and earnings impact from the expiry of a supply contract with a major automobile manufacturer at the end of June 2022 in its forecast.

"Thanks to the success of our transformation with leaner structures, clear responsibility for sales and earnings of the business units, an increased customer and market focus, and the sustainable cost savings achieved, we are now significantly more resilient and better prepared to master the current challenges," emphasizes Dr. Torsten Derr, CEO of SGL Carbon SE.

In line with the comments made above, SGL Carbon confirms the sales and earnings guidance. For fiscal year 2022, consolidated sales are expected to be at the prior year's level and adjusted EBITDA between €110 - 130 million. Taking into account depreciation and amortization, adjusted EBIT is forecast to be between €50 - 70 million. Furthermore, free cash flow at the end of fiscal 2022 is expected to be significantly below the prior-year level and return on capital employed (ROCE) between 5% and 7%.

Further details on business performance in the 1st quarter of 2022 can be found in the quarterly statement.

https://www.sglcarbon.com/news/multimedia/Key-figures-Q1-2022-en.jpg