#Composites

Initiated transformation shows effect in sales and earnings 2021 – SGL Carbon tops sales billion again

- Sales increase of 9.5% to €1,007.0 million driven by almost all business units

- EBITDApre improves by 50.9% to €140.0 million, reaching the upper end of the 2021 guidance raised in July

- Net financial debt reduced from €286.5 million to €206.3 million

- Start of business in 2022 overshadowed by uncertainty resulting from the war in Ukraine

"We have delivered. The 2021 sales and earnings figures support our forecast, which we raised in mid-2021. Looking back, we have significantly exceeded the financial targets set at the beginning of 2021 and have already realized in 2021 part of the increase in sales and profitability originally expected in 2022. The figures show that we have more than fulfilled our announcements and initiated a comprehensive and successful transformation process at SGL Carbon," says CEO Dr. Torsten Derr.

Earnings development of SGL Carbon

The increase in EBITDApre by €47.2 million to €140.0 million was driven in particular by the Business Units Graphite Solutions (+€24.8 million), Composite Solutions (+€16.8 million) and Carbon Fibers (+€13.1 million). In line with the positive development of the operating business units, the EBITDApre margin also shows a significant improvement from 10.1% to 13.9% in fiscal year 2021.

EBITDApre and EBITpre do not include one-off effects and non-recurring items totaling €30.7 million. The one-off effects are mainly composed of: Income of €19.7 million from the sale of two properties not required for operations, earnings of €18.2 million from the restructuring of pension obligations, and other effects amounting to minus €7.2 million.

Taking into account the described one-off effects and non-recurring items, as well as depreciation and amortization of €60.3 million, reported EBIT amounted to €110.4 million (2020: minus €93.7 million).

Based on the pleasing business performance, the successes of the transformation and non-operating one-off effects and non-recurring items of €30.7 million, the Group returns to positive earnings of €75.4 million in 2021 after three years.

Net financial debt and equity

In fiscal 2021, net financial debt was reduced significantly by 28.0% to €206.3 million compared to the end of 2020 (€286.5 million). A main driver of this development was the €79.1 million increase in cash and cash equivalents to €220.9 million (Dec. 31, 2020: €141.8 million), based in particular on free cash flow of €111.5 million (2020: €93.9 million). This includes cash inflows from the sale of properties not required for operations in the amount of €30.6 million.

Equity attributable to shareholders of the parent company rose significantly by €150.8 million (+68.3%) to €371.5 million in the financial year 2021 (December 31, 2020: €220.7 million). Correspondingly, the equity ratio increased to 27.0% (Dec. 31, 2020: 17.5%).

Due to the significantly improved earnings situation, return on capital employed (ROCE) also increased from 1.8% in the previous year to 8.0%.

"The primary objective for fiscal year 2021 was to secure the financial stability of SGL Carbon. With the significant reduction in net financial debt by almost one third, the improvement in the equity ratio by almost ten percentage points, and the substantial increase in return on capital, we were able to considerably strengthen SGL Carbon's financial base," explains Thomas Dippold, CFO of SGL Carbon.

Development of the Business Units

As the largest Business Unit with a 44% share of Group sales, Graphite Solutions contributed €443.6 million to Group sales in 2021 (2020: €407.5 million). The sales increase of 8.9% is based in particular on the positive development of the important market segments Semiconductor & LED as well as Automotive & Transportation. Especially volume as well as margin effects from the product/customer mix led to a significant increase in EBITDApre of 39.3% to €87.9 million in the Graphite Solutions segment.

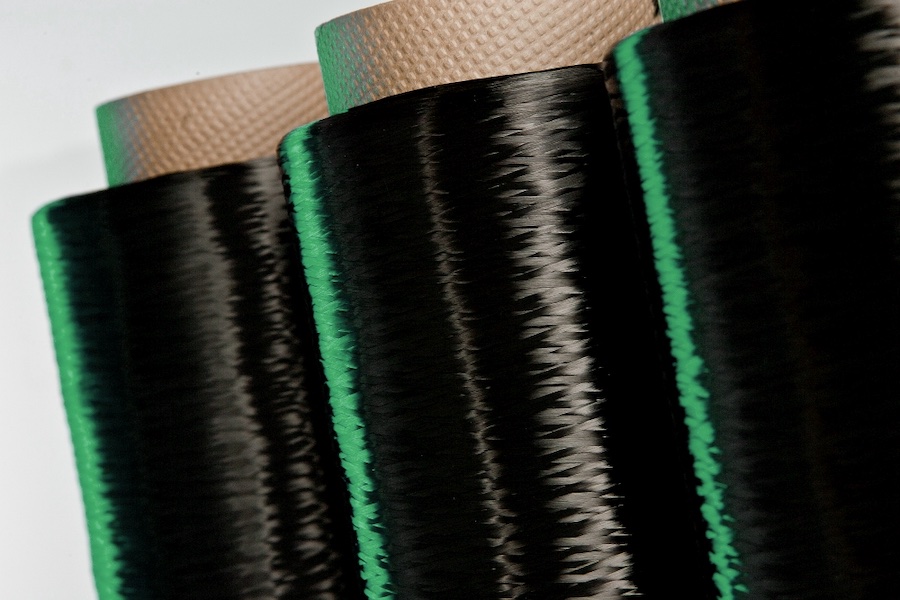

After a Corona-related difficult previous year, the Carbon Fibers Business Unit increased sales significantly by 11.0% to €337.2 million in 2021 (2020: €303.9 million) and accounted for 33% of Group sales. In particular, sales to automotive customers contributed to the sales plus. The segment's EBITDApre also developed positively, rising by 31.6% to €54.5 million (2020: €41.4 million). As of the second half of 2021, the energy-intensive business unit had to cope with drastically increased and volatile energy prices, which could not be fully compensated by cost savings and by passing prices on to customers.

The Composite Solutions Business Unit contributed €122.5 million (2020: €88.6 million) or 12% to Group sales. The year-on-year increase of 38.3% in 2021 is mainly based on higher volumes from existing customer contracts and the ramp-up of new orders from the automotive industry. Correspondingly, EBITDApre of the division developed pleasingly and turned positive for the first time at €12.1 million (2020: minus €4.7 million).

Only the Process Technology Business Unit, with a slight decline in sales of 1.1% to €87.2 million (2020: €88.2 million), was not yet able to participate in the general economic recovery. However, incoming orders in Q4 2021 show a pick-up in demand. Thanks to the success of the transformation initiatives, the Process Technology unit improved EBITDApre from €3.4 million to €4.7 million in 2021 despite a slight decline in sales.

As expected, sales in the Corporate segment were down year-on-year at €16.5 million (2020: €31.2 million), partly due to lower rental income resulting from the sale of non-operating properties. Despite the €14.7 million decrease in sales, EBITDApre for the segment fell by only €8.8 million, which is attributable to the streamlining of internal structures as part of the transformation.

Outlook

We expect to benefit from a further increase in demand in almost all market segments, supported by structural future trends such as growth in the semiconductor industry and the expansion of electromobility and renewable energies. The impact on sales and earnings of the expiry of a supply contract with a major automotive customer in mid-2022 is also included in our forecast for 2022. In this respect we have already taken countermeasures by acquiring new automotive customers and serving other growth markets such as wind energy.

On the other hand, price increases on the energy and raw material markets driven by the war in Ukraine as well as supply chain disruptions combined with production shutdowns at our customers could impact our business in fiscal 2022. In order to minimize the risks from further increases in energy prices, we have hedged a large part of our energy requirements for 2022 in the short term and adjusted our risk and forecast assessment accordingly. Our 2022 forecast implies that we will be able to pass on at least some of the factor cost increases to customers. Not yet included in our 2022 forecast are unforeseeable supply and production downtimes at our customers and a possible downturn in the global economy.

Based on the assumptions outlined and including the costs of the energy hedges, we expect Group sales for the 2022 financial year to be at the previous year's level and EBITDApre to be between €110 million and €130 million.

Further details on the business development in 2021 and the forecast for 2022 can be found in SGL Carbon's Annual Report.