Composites

Composites Germany – Results of the 8th Composites market survey are now available

- General business situation largely seen as positive

- Businesses are now more positive about their own future developments

- Investment climate continues to be friendly

- Shift in growth drivers

- Clear upward trend in Composites Index

As on previous occasions, the questions were left unchanged in order to ensure a smooth comparison with previous surveys, and the focus was largely on the qualitative data of general market developments as well as the specific situations in each composites segment.

General business situation largely seen as positive

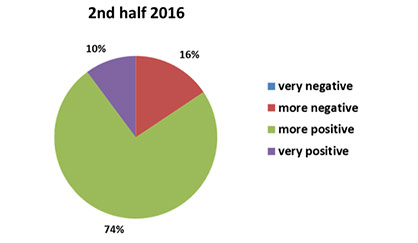

When asked to assess the general business situation in three regions – Germany, Europe and worldwide – the respondents came to highly positive conclusions again. While in the previous survey the vast majority described it as “quite positive” or “very positive” in the three regions, the current survey even displays a slight increase in this positive view. For example, 84% of respondents see the current worldwide business situation as positive (see Fig. 1).

Fig. 1: Current business situation – worldwide

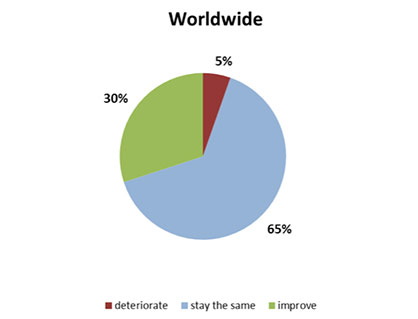

Cause for optimism also pervades attitudes towards the future in general. The vast majority of respondents believe that the situation will continue to develop positively in all the regions they were asked about, while some are even expecting further improvements (see Fig. 2).

Fig. 2: Development of general future business situation – worldwide

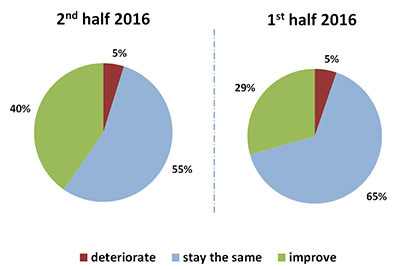

Businesses are now more positive about their own future developments

Whereas the previous survey displayed a downturn in the satisfaction of businesses with their own current and future situations, the current survey clearly shows an increase. In the last survey, for instance, 29% said they were expecting their situations to improve in Europe, whereas in the current survey this value has now risen to 40%. By contrast, the proportion of those expecting a negative development has stagnated at 5% (see Fig. 3).

Fig. 3: Development of own business situation – Europe

Investment climate continues to be friendly

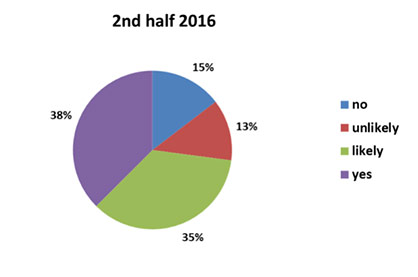

Positive values also continue to be observed in the investment climate (machinery and human resources). A clear shift can be noted, in particular, in machine investments. As before, nearly every other company is planning to recruit more staff. On the other hand, there has been a decline in the proportion of companies planning machine investment or seeing such investments as likely. However, as before, about three quarters (73%) are still assuming that they will invest in machinery (see Fig. 4).

Fig. 4: Companies planning to invest in machinery

Shift in growth drivers

Where growth drivers are concerned, the greatest growth stimuli can still be expected from the automotive and aviation industries. As for material, CRP (carbon fibre reinforced plastics) continues to be the number one growth driver, mentioned by 38% of respondents. Nevertheless, this is a significant downturn compared with previous surveys. Regionally, this is the first time that Asia is expected to deliver the greatest number of growth stimuli on the composites market, while Germany has dropped to second place.

Clear upward trend in Composites Index

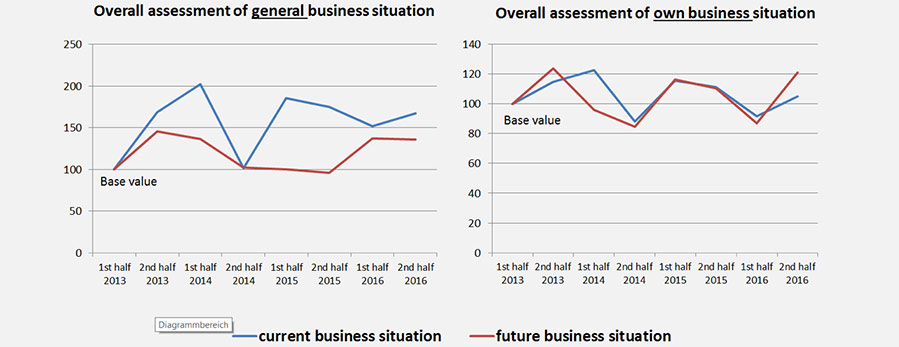

Compared with the previous survey, both the general economic situation and the companies’ own business situations are clearly seen as more positive. Whereas expectations on general business developments are similar to the previous survey, indicators of the businesses’ own futures are displaying a strong upward trend (see Fig. 5).

The survey shows that the respondents see their prospects as very positive for the coming months. The market is therefore likely to continue in its dynamic development – all the more so as half of all respondents believe that their businesses will become more active on the market, while only 2% are anticipating a decline.

The next Composite Market Survey will be published in July 2017.