#Raw Materials

Trade tensions and higher stocks add uncertainty to the cotton market

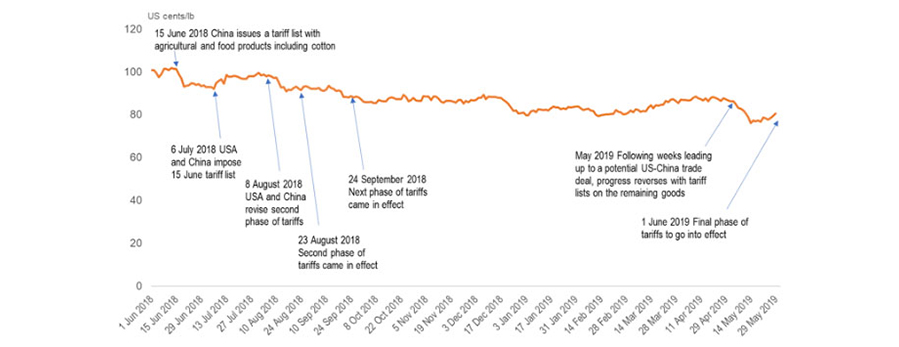

- The US-China trade war continues to escalate, with increasing retaliatory tariffs on both sides.

- There is an opportunity for de-escalation at the G20 Summit scheduled for late June, but both countries might be preparing for a protracted dispute.

- The tariffs have had an impact on the A Index, which hit a season-low of 76 cents per pound in mid-May.

- Production is projected to outpace consumption in 2019/20, exerting further downward pressure on prices.

There is some hope that American and Chinese representatives might be able to de-escalate the conflict later this month when they’re together at the G20 Summit in Osaka, Japan. However, the US government recently announced it will provide $16 billion in additional support to its farmers, potentially indicating plans for a prolonged standoff.

Prices have suffered from the escalating tariffs, dropping to a season-low of 76 cents per pound on May 14th. Although global consumption is expected to rise by 1%, production is expected to jump 7%, with the resulting increase in global stocks exerting further downward pressure on prices.

canva-900-1.jpg)