#Composites

SGL Carbon with solid business performance

In particular, the Graphite Solutions (GS) business unit contributed to the stable development of the Company with a 15.3% increase in sales to €280.6 million (H1 2022: €243.4 million) and a 20.6% improvement in adjusted EBITDA to €65.1 million (H1 2022: €54.0 million). GS benefited especially from the high demand of the semiconductor industry. The semiconductor and LED market segment now accounts for around 45% of GS revenue (H1 2022: around 35%).

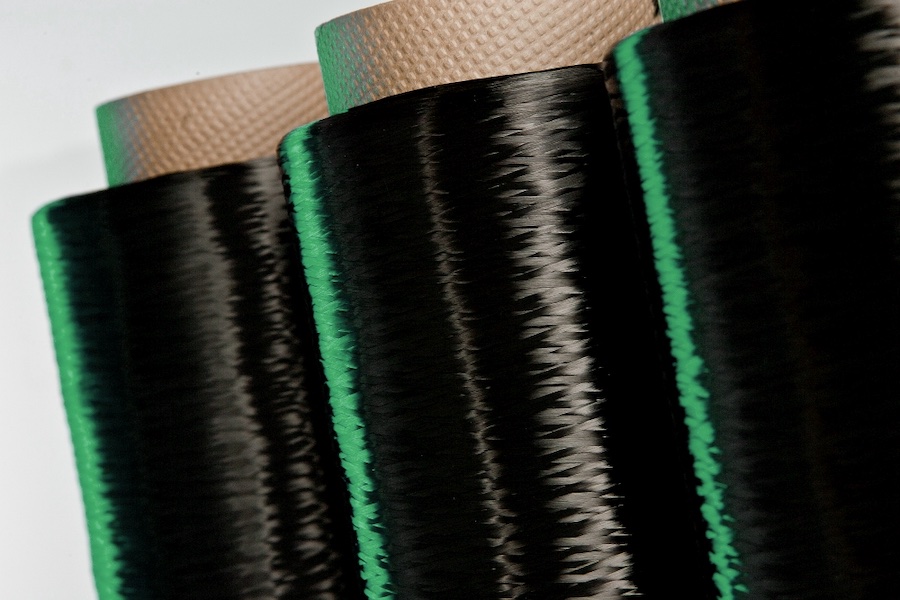

With a 30.9% increase in sales to €64.4 million (H1 2022: €49.2 million) and a significant rise in adjusted EBITDA from €4.1 million to €11.9 million, the business performance of Process Technology (PT) was significantly above the original planning. Composite Solutions (CS) also reported a higher-than-forecast sales increase of 14.4% to €79.6 million in H1 2023 (H1 2022: €69.6 million) and an improvement in adjusted EBITDA of 26.8% to €12.3 million (H1 2022: €9.7 million). By contrast, the business performance of the Carbon Fibers (CF) unit was not in line with expectations, with a 28.9% decline in sales to €125.1 million (H1 2022: €176.0 million) and a 78.4% drop in earnings to €6.1 million (H1 2022: €28.2 million).

An important market segment for the Carbon Fibers business unit is the wind industry. Demand for carbon fibers for the wind industry has declined sharply since the beginning of the year. According to current estimates, the expected recovery in demand in H2 2023 will not materialize. SGL Carbon expects customer demand from the wind industry to pick up in 2024.

As already announced in the ad hoc release of July 24, 2023, an impairment loss of €44.7 million was recognized on the assets of Carbon Fibers as of June 30, 2023.

Results situation

SGL Carbon's adjusted EBITDA (EBITDApre) remained almost stable in a half-year comparison at €88.0 million (H1 2022: €87.9 million). Due to the lack of demand from wind industry, CF's production capacity utilization decreased and idle capacity costs weighed on adjusted EBITDA. By contrast, higher margins from product mix and volume effects in the other three business units had a positive impact on adjusted EBITDA.

Non-recurring items and one-off effects not included in adjusted EBITDA totaled minus €46.9 million in the first half of 2023, of which €44.7 million resulted from an impairment loss in the CF business unit.

In addition to the above-mentioned effects and nearly unchanged depreciation and amortization of €29.1 million (H1 2022: €28.9 million), the decline in EBIT resulted in particular from the impairment loss already described (€44.7 million). After €69.6 million in H1 2022, EBIT amounted to €12.0 million in the reporting period.

Taking into account the slightly improved financial result of minus €15.8 million (H1 2022: minus €16.6 million), consolidated net income for the first six months of the current financial year amounted to minus €10.0 million, compared to €48.8 million in the first half of the previous year.

Net financial debt and equity

To complete its refinancing, SGL Carbon issued convertible bonds with a volume of €118.7 million in June 2023 and drew an existing term loan facility of €75 million in July 2023, which was used together with cash of the Company on July 28, 2023 to repay the corporate bond (outstanding as of June 30, 2023: €237.4 million). Accordingly, cash and cash equivalents increased to €310.5 million as of June 30, 2023 (€227.3 million as of December 31, 2022) and financial debt temporarily increased to €480.4 million (€398.1 million as of December 31, 2022). Net financial debt remained nearly unchanged at €169.9 million as of June 30, 2023 (Dec. 31, 2022: € 170.8 million).

Despite the impairment loss of €44.7 million in Carbon Fibers, shareholders' equity amounted to €565.2 million as of June 30, 2023, only slightly lower than at the end of 2022 (Dec. 31, 2022: €569.3 million). This corresponds to an equity ratio of 36.1% (Dec. 31, 2022: 38.5%).

Further details on business development and outlook can be found in the Group's interim report for the 1st half of 2023.