#Composites

SGL Group posts good first half-year results

- Group sales from continuing operations increased by almost 15 percent to 435.3 million euros

- Recurring Group EBIT rises more than proportionately to 22.5 million euros

- Graphite Materials & Systems (GMS) clearly improves operating profit year-on-year; operating profit of Composites – Fibers & Materials (CFM) stable, as expected

- Sales agreement for cathodes, furnace linings and carbon electrodes (CFL/CE) signed

- Closing of the two sales transactions of the former business unit Performance Products (PP) expected this year

- Dr. Jürgen Köhler, CEO of SGL Group: “After the sale of our former business unit PP, we will now focus fully on our growth businesses CFM and GMS”

Recurring EBIT increased significantly to 22.5 (prior year period: 9.6) million euros. Return on capital employed (ROCE) based on recurring EBITDA improved to 9.8 (prior year period: 8.3) percent.

On August 8, 2017, SGL Group signed an agreement to sell its cathodes, furnace linings and carbon electrodes (CFL/CE) business to funds advised by Triton. The two parties agreed on an enterprise value of 250 million euros. After deducting standard debt-like items, mainly pension provisions, as well as other customary adjustments, the transaction will result in cash proceeds of more than 230 million euros. The closing for this sale as well as for the sale of the graphite electrode business to Showa Denko are expected this year. With these two transactions, the former business unit Performance Products (PP) has been sold at a total enterprise value of 600 million euros and approx. 130 million euros above its book value on June 30, 2016.

“In the second quarter we continued with the performance seen at the beginning of the year,” says Dr. Jürgen Köhler, CEO of SGL Group. “This shows that our focus on the mega- trends mobility, energy and digitization was the right decision. Our strategic realignment is now close to the finishing line. The sale of our former Performance Products business unit means that we can now concentrate on our growth businesses Composites – Fibers & Materials and Graphite Materials & Systems.”

Group EBIT after non-recurring charges also improved substantially in the first half of the year, from 9.6 million to 15.7 million euros, despite an increase in non-recurring charges. The net financing result, at 26.2 (prior year period: 25.9) million euros, remained almost unchanged.

The SGL Group improved its result from continuing operations before taxes from minus 16.3 million to minus 10.5 million euros. Including discontinued activities, the Group’s consolidated net result after taxes in the first half of 2017 amounted to minus 3.6 (prior year period: minus 73.2) million euros.

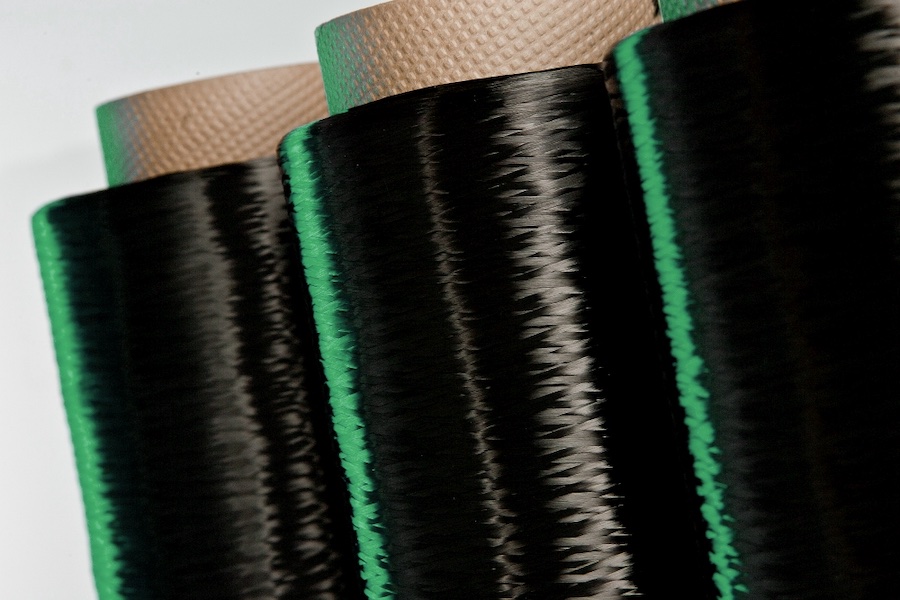

Composites – Fibers & Materials (CFM): sales significantly higher; earnings at previous year’s level due to ramp up of the Lightweight and Application Center

Sales in the first half of 2017 in the reporting segment Composites – Fibers & Materials increased by 12.6 percent, to 176.2 (prior year period: 156.5) million euros, primarily due to higher sales in the market segments industrial applications, automotive, and textile fibers. In the market segment industrial applications, carbon fiber sales for injection molding applications developed particularly well, while in textile fibers, the high oil price compared to the prior year period had a positive impact on selling prices. The market segments aerospace and wind energy recorded slightly lower sales.

As expected, recurring EBIT, at 12.4 million euros in the first half of 2017, remained at a similar level as in the comparable prior year period (12.2 million euros). The ramp up of the Lightweight and Application Center (LAC), which is designated to develop future business with the automotive and aerospace industries, offset operational improvements in nearly all market segments, as anticipated. The strongest earnings improvement was recorded in the market segment industrial applications, resulting from the good capacity utilization in the carbon fiber plant in Scotland. Higher sales led to a slight decrease in the EBIT margin to 7.0 percent (prior year period: 7.8 percent).

Return on capital employed (ROCE) based on recurring EBITDA increased from 9.9 percent to 10.8 percent. EBIT after non-recurring charges declined to 6.4 (prior year period: 12.2) million euros. The decrease is solely attributable to the disposal of the production site in Evanston, leading to a negative earnings effect from attributable cumulative currency translation differences amounting to approx. 6 million euros (positive effect of 12.8 million euros from the sale of Evanston was already recorded in the fiscal year 2016).