#Retail & Brands

VF Corporation reports broad-based growth in fourth quarter and introduces full year fiscal 2023 outlook

Q4'FY22 Financial Highlights

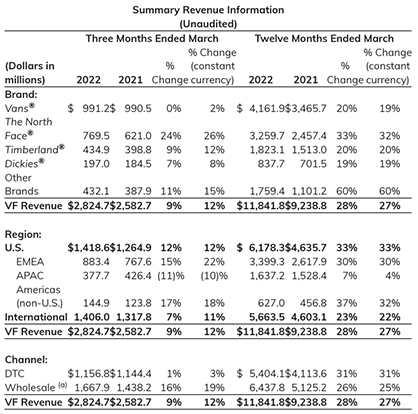

• Revenue $2.8 billion, up 9% (up 12% in constant dollars)

- The North Face® revenue $0.8 billion, up 24% (up 26% in constant dollars)

- Vans® revenue $1.0 billion, flat (up 2% in constant dollars)

• Gross margin 51.9%, down 20 basis points; Adjusted gross margin 52.2%, down 50 basis points

• Operating margin 6.8%, up 210 basis points; Adjusted operating margin 7.9%, up 120 basis points

• Earnings per share (EPS) $0.21, up 32%; Adjusted EPS $0.45, up 67%

• Return of $244 million to shareholders through $194 million in cash dividends, $50 million of shares repurchased

FY22 Financial Highlights

• Revenue $11.8 billion, up 28% (up 27% in constant dollars); excluding acquisitions, up 23%

• Gross margin 54.5%, up 180 basis points; Adjusted gross margin 54.8%, up 150 basis points, including a 20 basis point positive impact from acquisitions

• Operating margin 13.8%, up 720 basis points; Adjusted operating margin 13.1%, up 510 basis points, including a 30 basis point positive impact from acquisitions

• EPS $3.10, up 242%; Adjusted EPS up 143% to $3.18, including a $0.19 per share contribution from acquisitions

• Return of $1.1 billion to shareholders through $773 million in cash dividends, $350 million of shares repurchased

FY23 Financial Outlook

• VF provides the following outlook for full year fiscal 2023, which is based on these assumptions:

- No additional significant COVID-19 related lockdowns in any key commercial or production regions, with the current restrictions in China expected to ease from the beginning of June 2022

- No significant worsening in global inflation rates and consumer sentiment

• Total VF revenue up at least 7% in constant dollars

- The North Face® revenue up low double digit percent; Vans® revenue up mid-single digit percent

• Gross margin up approximately 50 basis points

• Operating margin approximately 13.6%

• Tax rate approximately 16%, returning to a more normalized rate

• EPS $3.30 to $3.40

• Adjusted cash flow from operations approximately $1.2 billion; Capital expenditures approximately $250 million

- Excludes the impact of a payment VF anticipates making to the Internal Revenue Service in fiscal 2023 of approximately $845 million plus accrued interest relating to the dispute regarding the timing of income inclusion associated with VF's acquisition of Timberland in 2011, as discussed in more detail below

Steve Rendle, Chairman, President and CEO of VF, said: ?"I am pleased with the progress we have made advancing our strategic priorities while successfully navigating another eventful year. We largely delivered on the commitments we made at the outset of Fiscal 2022 by achieving broad-based growth across our family of brands. A portion of our active segment did not achieve its potential. We understand the issues, we have the right people in place and we know we will do better.

"Our performance is testament to the incredible breadth and depth of talent across our organization and our teams continue to be highly resourceful, committed and passionate.

"We will continue to thoughtfully invest in our brands and value-enhancing strategic growth opportunities and I am confident VF has a long runway for sustained, profitable and broad-based growth ahead.”

All references to periods ended March 2022 relate to the 13-week and 52-week fiscal periods ended April 2, 2022 and all references to periods ended March 2021 relate to the 14-week and 53-week fiscal periods ended April 3, 2021.

Note: Amounts may not sum due to rounding

(a) Royalty revenues are included in the wholesale channel for all periods.

All per share amounts are presented on a diluted basis. This release refers to “reported” and “constant dollar” amounts, terms that are described under the heading below “Constant Currency - Excluding the Impact of Foreign Currency.” Unless otherwise noted, “reported” and “constant dollar” amounts are the same. This release also refers to “continuing” and “discontinued” operations amounts, which are concepts described under the heading below “Discontinued Operations - Occupational Workwear Business.” Unless otherwise noted, results presented are based on continuing operations. This release also refers to “adjusted” amounts, a term that is described under the heading below “Adjusted Amounts - Excluding Transaction and Deal Related Activities, Costs Related to Specified Strategic Business Decisions and Tax Items.” Unless otherwise noted, “reported” and “adjusted” amounts are the same. This release also refers to amounts "excluding acquisitions" or as "adjusted organic," which exclude the contribution from the Supreme® brand through the one-year anniversary of the acquisition.

Fourth Quarter Fiscal 2022 Income Statement Review

• Revenue increased 9% (up 12% in constant dollars) to $2.8 billion driven by increases in the EMEA and North America regions partially offset by a decline in the APAC region primarily due to COVID lockdowns. The fourth quarter of fiscal 2021 also included an extra week when compared to the fiscal 2022 period due to VF's 53-week fiscal 2021.

• Gross margin decreased 20 basis points to 51.9%, primarily driven by incremental freight costs. On an adjusted basis, gross margin decreased 50 basis points to 52.2%.

• Operating income on a reported basis was $192 million. On an adjusted basis, operating income increased 30% (36% in constant dollars) to $224 million. Operating margin on a reported basis was 6.8%. Adjusted operating margin increased 120 basis points to 7.9%.

• Earnings per share was $0.21 on a reported basis. On an adjusted basis, earnings per share increased 67% (up 76% in constant dollars) to $0.45.

Full Year Fiscal 2022 Income Statement Review

• Revenue increased 28% (up 27% in constant dollars) to $11.8 billion. Excluding the impact of acquisitions, revenue increased 23%, driven by increases in our largest brands and regions. Fiscal 2021 also included an extra week when compared to the fiscal 2022 period due to VF's 53-week fiscal 2021.

• Gross margin increased 180 basis points to 54.5%, primarily driven by a higher proportion of full price sales more than offsetting incremental freight costs. On an adjusted basis, gross margin increased 150 basis points, including a 20 basis point positive impact from acquisitions, to 54.8%.

• Operating income on a reported basis was $1.6 billion. On an adjusted basis, operating income increased 109% (up 107% in constant dollars) to $1.5 billion, including a $94 million contribution from acquisitions. Operating margin on a reported basis was 13.8%. Adjusted operating margin increased 510 basis points, including a 30 basis point positive impact from acquisitions, to 13.1%.

• Earnings per share was $3.10 on a reported basis. On an adjusted basis, earnings per share increased 143% (up 142% in constant dollars) to $3.18, including a $0.19 contribution from acquisitions.

COVID-19 Outbreak Update

To help mitigate the spread of COVID-19 and in response to public health advisories and governmental actions and regulations, VF has modified its business practices, including the temporary closing of offices and retail stores, instituting travel bans and restrictions and implementing health and safety measures including social distancing and quarantines.

The zero tolerance policy in China in response to COVID-19 is impacting some specific raw material suppliers within the country. The majority of VF's supply chain is currently operational. Suppliers are complying with local public health advisories and governmental restrictions. Most final product manufacturing and assembly suppliers are back to normal operating levels. Continued port congestion, equipment availability and other logistics challenges have contributed to ongoing product delays. VF is working with its suppliers to minimize disruption and is employing expedited freight strategically as needed. VF's distribution centers are operational in accordance with local government guidelines while maintaining enhanced health and safety protocols.

In North America, no stores were closed during the fourth quarter. Currently, all stores are open.

In the EMEA region, 6% of stores were closed at the beginning of the fourth quarter and at the end of the fourth quarter and currently no stores are closed due to COVID-19.

In the APAC region, including Mainland China, no stores were closed at the beginning of the fourth quarter. 12% of stores were closed at the end of the fourth quarter. Currently, 19% of stores are closed.

VF is continuing to monitor the COVID-19 outbreak globally and will comply with guidance from government entities and public health authorities to prioritize the health and well-being of its employees, customers, trade partners and consumers. As COVID-19 uncertainty continues, VF expects ongoing disruption to its business operations.

Balance Sheet Highlights

Inventories were up 34% compared with the same period last year. VF returned approximately $194 million of cash to shareholders through dividends during the quarter. The company also repurchased approximately $50 million of shares during the quarter and has $2.5 billion remaining under its current share repurchase authorization.

Dividend Declared

VF’s Board of Directors declared a quarterly dividend of $0.50 per share, payable on June 21, 2022, to shareholders of record on June 10, 2022. Subject to approval by its Board of Directors, VF intends to continue to pay its regularly scheduled cash dividend.

Update on Tax Dispute in Connection with Timberland Acquisition

As previously reported, VF petitioned the U.S. Tax Court (the Court) to resolve an Internal Revenue Service (IRS) dispute regarding the timing of income inclusion associated with VF’s acquisition of The Timberland Company in September 2011. While the IRS argues that all such income should have been immediately included in 2011, VF has reported periodic income inclusions in subsequent tax years. Both parties moved for summary judgment on the issue, and on January 31, 2022, the Court issued its opinion in favor of the IRS. VF believes the opinion of the Court was in error based on the technical merits and intends to appeal; however, VF will be required to pay the 2011 taxes and interest being disputed or post a surety bond. It is anticipated that during fiscal 2023, the IRS will assess, and VF will pay, the 2011 taxes and interest, which would be recorded as a tax receivable based on VF's expected probability of a successful appeal. The gross amount of taxes and interest as of April 2, 2022 was estimated at approximately $845 million and will continue to accrue interest until paid. VF continues to remain confident in its timing and treatment of the income inclusion and VF is vigorously defending its position. However, should the Court opinion ultimately be upheld on appeal, this tax receivable may not be collected by VF. If the Court opinion is upheld, VF should be entitled to a refund of taxes paid on the periodic inclusions that VF has reported. However, any such refund could be substantially reduced by potential indirect tax effects resulting from application of the Court opinion. Deferred tax liabilities, representing VF’s future tax on annual inclusions, would also be released. The net impact to tax expense estimated as of April 2, 2022 could be up to $700 million.

Webcast Information

VF will host its fourth quarter fiscal 2022 conference call beginning at 4:30 p.m. Eastern Time today. The conference call will be broadcast live via the Internet, accessible at ir.vfc.com. For those unable to listen to the live broadcast, an archived version will be available at the same location.

Presentation

A presentation on fourth quarter fiscal 2022 results will be available at ir.vfc.com today before the conference call and will be archived at the same location.