#Raw Materials

Brazil sees huge jump in share of China’s import market but most countries will see ranging from 7% to 73%

Highlights from the July 2020 Cotton This Month include:

- China and the USA will remain the world’s top importer and exporter

- Brazil’s share of China’s import market increased 170% in 2018/19 as US exports to China wilted under the 25% tariff

- Through the August – April period of the 2019/20 market year, US exports to China are up significantly but most countries will see their shipments to China decrease between 7% and 73%

- The Secretariat’s current projection for the year-end 2019/20 average of the A Index has been revised to 71 cents per pound this month

- The price projection for the year-end 2020/21 average of the A Index is 58 cents per pound this month

Although Phase One of their trade agreement went into effect on 20 February, the cotton industry had already seen several changes as a result of the troubles:

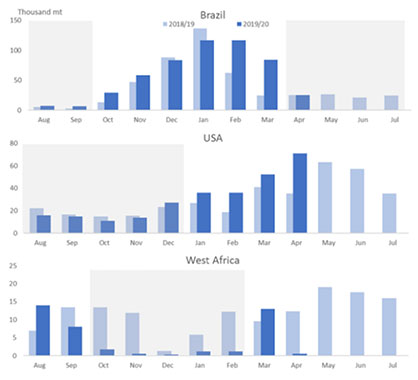

- Brazil has been the prime beneficiary of the USA’s losses in China, as the South American country saw its share of the Chinese import market increase by 170% in 2018/19.

- The news isn’t all bad for the USA, which is still expected to export 3 million tonnes globally in 2019/20 and from August through April saw its shipments to China reach 277,000 tonnes, up 29% from the previous period.

- For the 2019/20 season, most other countries are expected to find their shipments to China decrease, with West Africa’s exports declining by 48% and other countries that export to China seeing contractions ranging from 7% to 73%.

In terms of prices, The Secretariat’s current projection for the year-end 2019/20 average of the A Index has been revised to 71 cents per pound this month. The price projection for the year-end 2020/21 average of the A Index is 58 cents per pound this month.

Cotton This Month is published at the beginning of the month with the Cotton Update published mid-month. The Cotton Update, which is included in the Cotton This Month subscription, is a mid-month report with updated information on supply/demand estimates and prices. The next Cotton Update will be released on 15 July 2020. The next Cotton This Month will be released on 3 August 2020.